Are you covered by your homeowner’s insurance?: fox10tv.com

Angie’s List

Your home is a big investment and it’s an investment you want to protect. But when was the last time you reviewed your homeowner’s insurance coverage?

A nationwide Angie’s List poll found:

96% have homeowner’s insurance

Nearly 30 percent of respondents to a nationwide Angie’s List poll said it’s been two years or more since they reviewed their coverage with their agent.

Homeowner’s insurance is designed to protect damage from specific weather disasters, fire, theft, injuries, etc. You must then buy separate policies for floor and earthquake coverage.

Angie’s List, the nation’s leading provider of consumer reviews, asked highly rated insurance agents about homeowner’s insurance coverage.

10 tips to help homeowner’s get proper coverage:

Annual review: When you get your renewal notice, talk to your agent about whether you need to adjust your coverage. Update your policy if you have added square feet, remodeled, bought expensive items like jewelry/artwork/electronics, added a pet, boat, changes in your household, etc. Determine whether you have adequate liability insurance to protect yourself if someone is injured on your property. Consider increasing your liability protection if you install a pool, etc.

Get what you need: Replacement cost insurance covers the cost of replacing your home and is generally the policy for most homeowners. Your agent will evaluate your home and its contents and write a policy that would replace it at that value.

Get specific. Find out what your policy says about storm, water, mold, wind and flood coverage. In the past 10 years, companies have increasingly changed the language about these specific items. Ask about adding specific endorsements if your agent or company doesn’t offer the coverage you want.

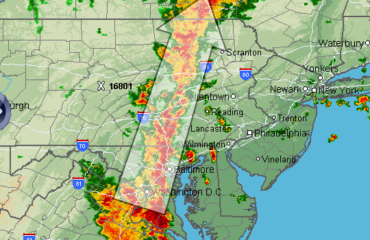

Flood warning. If you live in a low-lying area or one that is predisposed to flooding, purchase flood insurance from the National Flood Insurance Program.

Get loss of use coverage. Consider loss of use insurance to cover rent or hotel fees in the event your home is uninhabitable after a catastrophe. Experts recommend at least one year of coverage.

Claim deadline. Check with your state’s Department of Insurance for the statute of limitations for filing a claim, which can vary from one to two years.

Safe keeping. Put important paperwork, especially policy information, in a fireproof/waterproof safe. Take photos and videos of everything in your home. Keep the originals in a safe-deposit box and send copies to relatives or friends across the country.

Ask around. Don’t take an insurance adjuster’s proof-of-loss statement as accurate. Instead, use at least three independent contractors’ estimates as your starting point. The insurance company’s initial payout is often drastically lower than what the work will require.

Public adjuster. If you experience a sizable loss, consider hiring a public insurance adjuster who will file and submit your claim on your behalf. These adjusters often have years of experience on the private insurance side and work to get homeowners the best settlement possible. Their compensation is a percentage of your settlement. That percentage varies by state.

Crash course. Familiarize yourself with what you are entitled to receive in the event of a loss. Ask your agent about his or her experience in handling a loss claim. An experienced agent should be able to not only detail what your policy will and will not cover, but be able to give you a good idea of what to expect if a claim takes place.

Angie’s List Tips to get the best deal:

Improve your home’s safety: Severe weather, higher rebuilding costs and an increase in claims can all affect the price of your premium. Some companies offer discounts for installing storm shutters, adding a security system, updating wiring, or your home’s proximity to a fire station.

Bundle up: Many companies will reduce your rates if you purchase additional policies, such as auto or life, through them.

Raise your deductible: Just remember if you do have a claim, you are going to have to pay more out of pocket then you would have before.

Shop around: Like any other service, shop around for homeowner’s insurance rates. You can comparison shop online with just a click of a mouse. Comparing policy coverage options with a few companies will give you the opportunity to find the best policy at the best price.