Tim Boyle/Getty Images(NEW YORK) — State Farm Insurance, the nation’s largest home insurer, faces a new criminal investigation in Texas related to how it handled potentially tens of thousands of hurricane claims there, ABC News has learned exclusively.

Tim Boyle/Getty Images(NEW YORK) — State Farm Insurance, the nation’s largest home insurer, faces a new criminal investigation in Texas related to how it handled potentially tens of thousands of hurricane claims there, ABC News has learned exclusively.

Gregg Cox, who leads the public integrity unit of the Travis County District Attorney’s office in Austin, confirmed to ABC News that his investigators recently launched the probe after reviewing newly released communications from top State Farm managers in Texas. Some of the same communications have led to lawsuits by customers who say they were defrauded by State Farm Lloyds, the Texas subsidiary of the larger insurance company.

The documents in question relate to an alleged cover-up by State Farm management related to its denial of consumer insurance claims for a common type of roof damage that occurs during high wind events and hurricanes.

Jim Warner, a longtime homeowner in Missouri City, Texas, had been a customer of State Farm Insurance for more than 20 years before finding himself in the center of the now brewing criminal investigation. He says he had never filed an insurance claim until Hurricane Ike in 2008 and had always paid his monthly bills to State Farm on time.

However, Warner filed suit against State Farm after he says the company did not follow through on its slogan that promises, “Like a good neighbor, State Farm is there.” Warner always believed his policy would cover all types of damage to his roof, but when he went to file a claim he says he was shocked to learn that was not the case.

Warner’s lawsuit alleges that State Farm documents establish a clear internal policy of intentionally denying consumer claims for roof damage similar to what Warner experienced. Warner’s attorney, Steve Mostyn, claims the systematic denial of those types of claims may have quietly saved State Farm close to $1 billion.

Mostyn says State Farm documents obtained in the lawsuit reveal an attempt by managers to hide the company’s policy of non-payment from state insurance regulators.

“They absolutely went through an effort to cover it up,” Mostyn said. “These emails are coming from the top. They’re setting policy. And that policy by their own admission … shows conclusively they have not paid thousands of people.”

In Warner’s case, his problems began after he says the high winds of Hurricane Ike caused the shingles on his roof to become “lifted.” Those winds, Warner alleges in his suit, broke the seal under Warner’s shingles that normally create a water-tight barrier. Warner says an independent adjuster he hired agreed the damage was extensive and recommended Warner’s roof be replaced.

Warner alleges, however, State Farm repeatedly refused to admit the unsealed tabs were damage that should be paid under the policy. So Warner filed a consumer complaint with the Texas Department of Insurance, hoping the regulator could help. However, Warner’s lawsuit says it was during that very investigation of his complaint to insurance regulators that State Farm began to cover up its practices of refusing to pay for this kind of damage.

ABC News reviewed documents obtained in the lawsuit including an initial draft of State Farm’s response to insurance regulators about Warner’s complaint. In that draft letter, State Farm clearly disclosed how the company did not pay for insurance claims related to broken seals on roofs, saying, “Regarding the detached seals, there is no coverage as this condition is not considered… physical loss.”

However, when the “catastrophe section manager” for State Farm saw that statement written out, he directed it be removed from what state regulators would be told, instructing, “This letter needs to be revised to delete the reference to unseal tab.”

The reference was subsequently removed, and that same catastrophe manager then forwarded the newly revised letter to other unnamed colleagues at State Farm “for your review” before it was sent off to the state.

Attorney Mostyn says State Farm fought hard to keep from having to disclose those and other documents, but lost the fight. He says other documents show the insurer attempting to delete other references to the company’s policy of not paying lifted-shingles claims.

Warner’s lawsuit alleges that nearly 100,000 people may have had their claims for similar problems wrongly denied, estimating that many additional consumers who did not hire independent investigators to inspect their roofs may be unaware they are actually damaged today and susceptible to problems in future windstorms.

ABC News has confirmed grand jury subpoenas have been served to State Farm.

“We have requested a large amount of information from them, and they are complying with our requests,” said Cox.

State Farm declined an interview request for this story. However, the insurer said in a statement that, “State Farm Lloyds is cooperating fully with the Travis County investigation and has successfully settled the majority of civil litigation involving Hurricane Ike claims. To date, we have paid policyholders more than $1.5 billion dollars, much of which went to repair or replace roofs. We have been actively working to resolve questions related to roofing shingle claims. We will continue these efforts to maintain the trust of Texas homeowners, of which more than one in six has placed their confidence in State Farm Lloyd’s to protect their homes.”

State Farm Lloyds says it will soon file papers with the court disputing the claims made in Warner’s recently amended lawsuit.

- Published in In the News

Congress has given itself two more months to come up with long-term solutions for the debt-burdened federal program that provides insurance for homes and businesses in areas subject to flooding.

Congress has given itself two more months to come up with long-term solutions for the debt-burdened federal program that provides insurance for homes and businesses in areas subject to flooding.

A voice vote in the House Wednesday extended the life of the National Flood Insurance Program for 60 days, assuring that people in flood-risk areas will continue to have access to the flood insurance they need to close on mortgages or obtain refinancing. The program is slated to expire Thursday.

The last full-scale re-authorization of the NFIP, a wing of the Federal Emergency Management Agency, occurred in 2004. Since 2008 the insurance provider has stayed alive through a series of 16 short-term extensions while lawmakers debate how to restore its fiscal soundness.

The NFIP was largely self-financing until it was overwhelmed by claims from hurricanes Katrina and Rita in 2005. It now owes nearly $18 billion to the Treasury.

Rep. Judy Biggert, R-Ill., chair of the House Financial Services subcommittee on insurance, said she hoped Wednesday’s 17th stopgap measure would be the last, “because this program is too important to let lapse, and too in-debt to continue without reform.”

She said Senate leaders had given public and private assurances that they would vote on a long-term extension in June.

The House last year passed a five-year extension that allowed for increased premiums and ended some subsidies, but the Senate has been unable to get a companion bill to the floor for a vote.

The Senate last week passed the 60-day extension after adding a provision by Sen. Tom Coburn, R-Okla., that would gradually eliminate premium rate subsidies for people buying second homes and vacation homes in flood-prone areas. Coburn said that could save the program $2.7 billion over 10 years.

The NFIP was created in 1969, partly to fill the gap left by the unwillingness of private insurers to provide flood insurance. It now covers some 5.6 million policyholders in 21,000 flood-prone communities

- Published in In the News

WASHINGTON — Florida’s battered housing market will get some temporary relief if the U.S. House, as expected, approves a 60-day extension today of the National Flood Insurance Program before it expires on Thursday.

WASHINGTON — Florida’s battered housing market will get some temporary relief if the U.S. House, as expected, approves a 60-day extension today of the National Flood Insurance Program before it expires on Thursday.

But Congress is also considering broader changes that will raise rates and phase out coverage for some businesses and homeowners, especially for second homes or vacation houses. Here’s how today’s action and a revamp would impact the state:

Q: How will home sales be affected by this extension?

A: Flood insurance is essential to complete home purchases in much of low-lying Florida. You can’t get a federally backed mortgage in flood plains and some waterfront areas without coverage. The flood program has lapsed or brushed against an expiration date several times in recent years, complicating and sometimes delaying real estate closings that come around the same time.

“The first time, it caught everybody by surprise. But the industry has learned to be pro-active. I just have my clients go out and buy insurance now, even if they don’t close for another week or 10 days,” said Charles Kiesel, a mortgage lender in Cooper City. “We’ve learned how dumb our government is, how it runs right up to the deadline.”

The Senate approved a 60-day extension last week, and Republicans and Democrats agreed to debate a more substantial bill in June that would overhaul the program and continue it for five years. However, the 60-day extension comes with one significant change: subsidized coverage for second homes or vacation homes will be phased out over four years, raising rates for those who buy them.

Q: How much more will that cost buyers?

A: The cost of flood coverage varies widely, but the average is about $570 a year. Subsidized rates apply to about 20 percent of those covered and to houses built before flood-zone maps were issued in the mid-1970s. Subsidies cover up to 65 percent of the premium.

So phasing out subsidies will add to the cost of buying vacation homes, but probably not enough to discourage many buyers. Kiesel said, “Somebody buying a house for half a million dollars in Florida isn’t going to worry too much about paying another $40 or $50 a month for flood insurance.”

Q: What kind of changes will come if Congress passes the five-year bill?

A: The House bill, passed last year, differs from the Senate’s version to be considered in June, but both would phase out subsidized coverage for commercial buildings and homes that have been frequently flooded.

Rates would be set more in line with the risk of flooding. The legislation would allow the Federal Emergency Management Agency to buy “re-insurance” from private companies to back up the program. And it would allow the agency to explore selling “catastrophe bonds” to set up a reserve fund to cover the cost of massive disasters.

Q: Will that hike premiums?

A: Premiums already are due to go up by 5 percent this fall and may gradually increase by as much as 20 percent in higher-risk areas. Phasing out subsidies would mean even higher costs for affected businesses and homeowners.

“For those currently paying subsidized rates, eventually you might pay about double the amount,” said R.J. Lehmann, an insurance expert at The Heartland institute, a free-market think tank in Washington.

Q: What’s the hang-up in Congress?

A: The big issue is the program’s $18 billion debt, with no way to pay it back. The program hemorrhaged money after a batch of storms struck Florida and other Gulf Coast states in 2004 and 2005, culminating in Hurricane Katrina.

Some in Congress want to cancel the debt, but many others call that irresponsible and say the program must at least pay its ongoing costs based on actuarial risk, much like private insurance.

“If we were to have a sound and financially stable program, it has to be able pay big claims without going back to the treasury,” Lehmann said.

Q: Who is pushing to save the program, and who wants to change it?

A: A leading critic is Sen. Tom Coburn, R-Okla., who threatened to block the 60-day extension unless it included a provision to end subsidized coverage of vacation homes. Many Republicans in Congress say the program distorts the housing and insurance markets, and some environmental groups say it encourages damaging development in flood-prone places.

But most Florida members are struggling to preserve it, knowing that Floridians hold 2.1 million of the nation’s 5.6 million policies. Sen. Bill Nelson, D-Fla., who faces a tough re-election campaign, has been especially eager to renew it.

“Sen. Coburn was going to hold up a short-term extension of the entire flood-insurance program unless he got changes to second-home coverage,” said Nelson spokesman Dan McLaughlin. Within 60 days, he said, “we’ll be debating a long-term plan and address any needed changes then.”

- Published in In the News

Tropical Storm Isaac’s slow, rainy march up the Mississippi River valley is expected to cause as much as $2 billion in insured losses, according to one disaster modeling firm.

Tropical Storm Isaac’s slow, rainy march up the Mississippi River valley is expected to cause as much as $2 billion in insured losses, according to one disaster modeling firm.

The storm, which hit Louisiana Tuesday night as a Catagory 1 hurricane, continues to wreak havoc, with heavy rainfall flooding waterways. Working its way up to Missouri, the storm has left more than 800,000 without power in Louisiana, Mississippi, Alabama and Arkansas, power companies told CNN. Hundreds of residents in coastal areas and along rivers have had to be rescued. And 28 Louisiana parishes were without safe, clean water on Friday.

The catastrophe modeling firm AIR Worldwide said early Friday they estimate the storm has caused between $700 million and $2 billion in insured losses. That includes residential property, commercial property, energy production and the interruption of business but excludes most flooding damage.

“Isaac’s slow forward speed and refusal to dissipate will exacerbate wind damage,” said Tim Doggett, chief scientist at AIR.

Earlier this week, another modeling firm, Eqecat, a catastrophe modeling firm, suggested onshore insured damage would run between $500 million and $1.5 billion. The firm has yet to update its figures.

Both firms exclude flooding because the federal government insures against flood damage for most properties.

At those estimates, Isaac, with winds topping out at 80 miles an hour, is far less damaging than Hurricane Katrina, a Category 3 storm, with winds around 125 per hour. Some 1,800 people died after that storm when New Orleans levees failed to hold back rising flood waters. Katrina caused $45 billion in private insurance damage, excluding flood losses, according to the Insurance Information Institute.

But Isaac resembled Hurricane Gustav, a 2008 Category 2 storm that followed a similar path and caused $2 billion in insured damages.

While flooding isn’t included in the newly released damage estimates, Isaac’s total economic damages, including damage due to floods, are expected to grow, as the storm slowly crawls through Arkansas today. More flash flooding and tornadoes are expected.

“It’s looking more disorganized, but it is still putting out quite a bit of rain,” said Charles Dalton, a National Weather Service meteorologist in Little Rock, which was expected to get 5 inches of rain on Friday.

The longer the storm lasts, the risk that more flooding damage occurs, said Michael Kistler, director of model solutions at RMS, another catastrophe modeling firm.

“Because of it’s staying in one place a long time, there’s the potential for storm surge,” Kistler said. “This is not a Katrina,” he added later.

- Published in In the News

Tropical Storm Isaac may have cleared the area and headed north, but South Florida was still being whipped by sheeting rains and gusty winds Monday and Tuesday. Due to all of the rains, South Florida has seen some major flooding in areas like Wellington, Miami-Dade, West Palm Beach, and Tamarac.

Forecasters warned that Isaac was a large storm whose effects could reach out 200 miles from its center. Water may be worse than wind because the storm could push walls of water while dumping rain to flood the low-lying coast in Louisiana, Mississippi, Alabama and the Florida Panhandle

Isaac was packing top sustained winds of 70 mph and had not yet reached hurricane strength late Tuesday morning. The storm system was centered about 80 miles south-southeast of the mouth of the Mississippi River at 11 a.m. EDT and was moving northwest at 10 mph, according to the National Hurricane Center in Miami. It was 165 miles southeast of New Orleans.

Forecasters at the National Hurricane Center warned that Isaac, especially if it strikes at high tide, could cause storm surges of up to 12 feet along the coasts of southeast Louisiana and Mississippi and up to 6 feet as far away as the Florida Panhandle.

Rain from the storm could total up to 14 inches, with some isolated areas getting as much as 20 inches, along the coast from southeast Louisiana to the extreme western end of the Florida Panhandle.

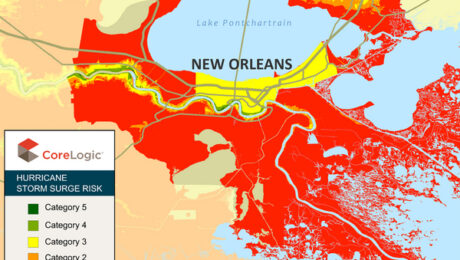

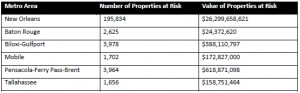

According to new data released today by CoreLogic, there is potentially over $27 billion in exposure to residential property damage from storm surge flooding as Tropical Storm Isaac makes its way across the Atlantic Ocean along a projected path toward the Gulf Coast.

“Based on current forecasts, Tropical Storm Isaac is predicted to strengthen into a Category 1 hurricane and become the first hurricane to impact the United States this year,” said Dr. Howard Botts, vice president and director of database development for CoreLogic Spatial Solutions.

Major metro areas that could potentially feel the impact of hurricane-driven storm surge include New Orleans, La.; Baton Rouge, La.; Biloxi, Miss.; Mobile, Ala.; Pensacola, Fla. and Tallahassee, Fla., depending on where the storm makes landfall.”

The data shows nearly 210,000 total residential properties valued at more than $27.7 billion in seven major metro areas along the Gulf Coast could be at risk for storm-surge related flooding, assuming the storm hits as a Category 1 hurricane. The number of residential properties in each metro area and their respective potential exposure to damage are as follows:

Hurricane-driven storm-surge flooding can cause significant property damage when high winds, forward movement of the storm and low pressure causes water to amass in front of the storm, pushing a powerful rush over land when the hurricane moves on shore.

Hurricane-driven storm-surge flooding can cause significant property damage when high winds, forward movement of the storm and low pressure causes water to amass in front of the storm, pushing a powerful rush over land when the hurricane moves on shore.

The CoreLogic analysis measures damage from storm surge and does not include potential damage from wind and rain associated with hurricanes.

- Published in In the News

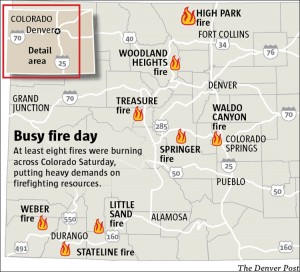

Colorado has already reached an overwhelming and devastating wildfire season reaching historic levels for 2012. New insurance claim estimates from hail, wind, and flooding have caused mayhem on June 6th from South Denver-Metro down to Colorado Springs, and then caused a second round on June 7th in Northern Colorado and Eastern Plains make it the state’s fourth most expensive catastrophe, with an estimated 69,842 auto and property claims totaling $321.1 million.

Insurance companies track both storms as one event so damage estimates include 33,459 auto claims and 36,383 property claims. The majority of the damage was to roofs, along with hail tattered and flooded vehicles.

“Colorado is already experiencing its most destructive wildfire season and Mother Nature doesn’t appear to be letting up any time soon,” says Carole Walker, executive director of the Rocky Mountain Insurance Information Association. “While wildfire can exact a more devastating personal toll, this is a stark reminder that hail is still historically the state’s most costly insured catastrophe due to the widespread damage to cars and property.”

If you have suffered hail damage to your home or business, it is not something that is easily seen. Be sure to get a licensed public adjuster to come out to your property and evaluate your damage. Be sure that you have someone protecting your best interests because insurance companies have independent adjusters that only protect their best interests. Call American Public Adjusters for a free claim evaluation if you have suffered hail damage, wind damage, storm damage, or flood damage.

- Published in In the News

Due to the severe heavy rains and lightning on Saturday, Monmouth and Ocean County, as well as Sections of Middlesex, Bergen, and Passaic County have experienced severe property damage, flooding and power outages.

Due to the severe heavy rains and lightning on Saturday, Monmouth and Ocean County, as well as Sections of Middlesex, Bergen, and Passaic County have experienced severe property damage, flooding and power outages.

Weather reports indicate that this was a disturbance at the jet stream level, combined with warm, humid air that was already in place, caused the storm. This upper-level disturbance made the moist air rise quickly and condense into thunderstorm clouds, bringing a lot of rain. The storms began to gather strength while crossing eastern Pennsylvania and came down hard on most of New Jersey, particularly Shore areas.

As a result, Freehold Township suffered some of the worst losses, and still have thousands of residents without power. Some of the other areas affected were East Windsor, Long Branch, and Atlantic City.

The bad news is that the state may not be out of the woods yet. With the intense humidity expected to linger a few more days, there is a “potential” for heavy storms to return on Wednesday. A cold front moving in Wednesday could bring thunderstorms containing heavy downpours and damaging winds up and down the eastern seaboard from Florida to New York.

Near Oak Street in Freehold, people stated that they heard terrible noise outside their homes. It was hail. They reported that is sounded like golf balls being thrown at their houses. Some homeowners even hid in their basements off of Enright Avenue. Transformers exploded throughout the neighborhood, sending sparks into the air. Trees fell all through the town, being completely uprooted, falling on homes, garages, and even cars. Fortunately, no one was hurt.

Although no one was injured by the storm, homes and surrounding areas were hit pretty badly. Cleanup of these areas will take a lot of time.

From an insurance standpoint, be sure to photograph all of your damages and contact a public adjuster to get the advice you need. Many people are unaware of what is specifically covered on their policies and the insurance company will do everything in their power to deny your claim. You need to make sure that you have the proper representation and someone standing by your side to justify your damages and provide you with a proper estimate to fix your property. Public Adjusters can assist you with your home, business, or vehicles that have been damaged due to these storms. A public adjuster does not make any money upfront and only takes a percentage if and when they collect money for you. Calling All American Public Adjusters may be the smartest decision you make for your claim. Don’t hesitate to call today and get informed! 800.501.1230

- Published in In the News

While residents of Freehold woke up Sunday morning to extensive damage from a late Saturday night storm that looked for all the world like a twister had struck, weather officials have ruled out a tornado and fingered an uncommon supercell storm as responsible for all the damage.

While residents of Freehold woke up Sunday morning to extensive damage from a late Saturday night storm that looked for all the world like a twister had struck, weather officials have ruled out a tornado and fingered an uncommon supercell storm as responsible for all the damage.

“Supercell storms are mainly responsible for a lot of high-end severe weather,” said Jim Hayes, a meteorologist with the National Weather Service in Mount Holly.

“If it had been a tornado, there would be signs of a defined path and rotation on the ground,” said Kristin Kline, another meteorologist with the National Weather Service. “From all indications we’ve received as far as damage reports and radar, it looks to be straight-line wind damage. When winds descend from a thunderstorm, they hit the ground and travel horizontally outward from that center point.”

A supercell storm is a strong version of a thunderstorm that lasts for a couple of hours as opposed to the average thunderstorm length of 20 to 30 minutes, Hayes said.

The two weather conditions needed to produce a supercell storm are an atmospheric area with high instability and an increase in wind strength with altitude. These two conditions create a spinning storm that then powers itself, Hayes said.

Saturday night’s storm brought wind gusts as high as 60 to 65 mph between 10 p.m. to 10:30 p.m. in Monmouth County. That 30-minute span was the most damaging part of the storm, Kline said. Trenton-Mercer Airport registered a gust as high as 63 mph shortly after 9 p.m., she said.

Saturday night’s storm, which followed an afternoon storm that caused flooding in parts of Ocean County, originated in Bucks County, Pa., and then passed through Mercer County before it entered Monmouth County.

The Freehold area and borough of Eatontown suffered the brunt of the storm’s fury. The storm left more than 4,800 Jersey Central Power & Light customers in the Freehold area without power Sunday morning, according to the company’s power outage map.

Hayes recalled such a storm that hit the area between Toms River and Howell townships with reported 75 mph wind gusts just two weeks ago. But Hayes said supercell storms are more commonly found in the southern and central plains.

- Published in In the News

COLORADO SPRINGS — Charred and contorted metal strips formed a stark barrier around piles of blackened rubble that used to be a two-story ranch style home at 5533 Majestic Drive.

COLORADO SPRINGS — Charred and contorted metal strips formed a stark barrier around piles of blackened rubble that used to be a two-story ranch style home at 5533 Majestic Drive.

“These were our beige gutters,” said Michael Fender, nudging the metal with his right foot. “I just don’t know … I don’t know what it is anymore.”

Fender and his wife lived in the three-bedroom home for 13 years, and on Thursday afternoon began preliminary inspections for what can be a painful and lengthy claims process in the wake of the Waldo Canyon fire. Aerial photographs show their street and a planned neighborhood known as Parkside lost at least 139 of their 178 homes in the blaze.

“It’s a rough situation,” said Mark Nix, an insurance property adjuster with Allstate who worked with couple. “In this first meeting, I just needed to measure the foundation and driveway and take some pictures.”

Since arriving in Colorado Springs earlier this week, Nix said he’s inspected about a dozen properties destroyed by the fire.

Following the initial site visit, the adjuster will then meet with residents a few days later to go over their personal property lost in the disaster.

“There’s a number of stages that it takes,” Nix said. “Eventually we hope to write them an estimate to get them rebuilt.”

Nix, based in Texas, travels all over the country — he has seen the damage wrought by floods, tornadoes and hurricanes.

“They’re all bad,” he said. “It’s heartbreaking.”

Colorado’s two largest property insurers reported Thursday that they received 1,449 claims for wildfire losses or expenses. The claims include total structural losses as well as damage from smoke and fire and requests for temporary living expenses from property owners displaced by fires.

Officials with State Farm said it had received 150 claims from northern Colorado’s High Park fire and 390 claims for the Waldo Canyon fire. Farmers Insurance representatives said the company has received 909 claims from all Colorado wildfires, with the majority from High Park and Waldo Canyon.

Both companies expect the numbers to grow as more fire damage is discovered and reported.

With a heavy thunderstorm forecast for this weekend, monsoon season likely to arrive in late summer and hillsides stripped of vegetation by the flames, residents in the area face another danger: Mud.

“Many homeowners do not realize the standard homeowners insurance policy typically excludes mudflow type losses,” Christopher Hackett, a director for the Property Casualty Insurers of America, said in a statement.

Across Majestic Drive from Fender’s home, Eugene and Cheryl Keckritz stood in their concrete driveway fixated on the foundation where their 2,200-square-foot home of 18 years once stood.

“It was Navajo white, with Zeus green trim,” said Cheryl. “We lost a lot. My dad’s old tool box … he died four years ago, and that’s what I kept as a memory of him. Now it’s gone.”

The Keckritzes said they’re fully insured and estimated their home was worth $240,000.

“I want to rebuild. We hope to rebuild, but right now it’s just too early,” Cheryl said.

- Published in In the News

An insurance trade organization says the hailstorm that pounded Dallas this week could result in up to $2 billion in insured losses.

An insurance trade organization says the hailstorm that pounded Dallas this week could result in up to $2 billion in insured losses.

Sandra Helin, president of Southwestern Insurance Information Service, said Friday that the estimate is preliminary and based on claims filed over the previous 36 hours. Helin added that “we are hopeful that the damage estimates fall short of what we are predicting.”

Helin said Wednesday’s storm was catastrophic due to a massive number of vehicles caught in the open during rush hour, the tens of thousands of homes that received roof and interior damage and the number of historic homes that were heavily damaged.

Hail storms can cause massive damage to commercial and residential properties. Here are some facts you should know about hail damage.

-I took a look at my roof and called a roofer to inspect, but it does not seem like three are any problems.

Fact: Roofing systems must actually be inspected by someone who has training, knowledge and experience to establish if there is actual hail damage. An insurance company sends their adjusters through rigorous special training so they can properly identify damage from hail. Unfortunately, roofers and home inspectors do not go through the same training.

-I do not see any missing shingles, so I don’t think I have damage.

Fact: Missing shingles are generally related to wind damage. They can happen during a hail storm only if the winds become high enough. Hail damage is unsafe in nature and may not physically cause leakage for years after a hail storm.

-I think I only have a year to file a claim.

Fact: There are several insurance companies that do have a one year time limit. However, due to the nature of hail damage, insurance companies may pay claims past the deadline if a hail storm is widespread geographically.

– I have a brand new roof on my home so shouldn’t it be covered by the manufacturers warrants, homebuilder, or contractor?

Fact: Generally, manufacturers, home builders, and roofing contractors will specifically name hail as an exclusion to their product warranty. If you have a newer roof, it can actually be more vulnerable to hail damage opposed to older roofs. This is because it takes a new roof time to cure from exposure to the elements.

-My roofer told me that my roof has very little damage and therefor I would not need to file a claim.

Fact: Even with minimal damage, it is very important to file a claim with your insurance company. Because your roof might not leak for years, as long as you notify your insurance company that the damage occurred, your claim can always be reopened later. This is why it is imperative to have a qualified expert inspect your roof.

– Won’t my insurance company throw me off my insurance if I file a claim?

Fact: In most states, insurance companies are prohibited from canceling policies for filing claims that occur from severe weather related events. You might want to check with your state and policy language.

– If I file a claim, the insurance company will raise my rates.

Fact: After any natural disaster, whether it is hurricane, hail, tornado, or flood, an insurance company can raise everyone’s rates. Even if you decide not to file a claim, your insurance rate might still go up. By not filing your claim, your rate increase can pay for everyone’s damage except yours.

The bottom line is that if you suffer from hail damage, you need an expert to verify your damage and you should file your claim immediately. The long term effects of hail damage are terrifying. You should protect your home at all costs. Isn’t that why you have insurance?

If you are located in the following areas, you may have sustained hail damage – Dallas, TX

Public Adjusters can also assist you with you vehicle claims as well. If you are unsure if the insurance company has paid enough for your vehicle or you have been paid and you do not feel that it was enough to cover your vehicles expense. Contact us today. You can receive more money for diminished value for your car claim. 800.501.1230

- Published in In the News