- Listen to a NOAA Weather Radio for critical information from the National Weather Service (NWS).

- Check your disaster supplies and replace or restock as needed.

- Bring in anything that can be picked up by the wind (bicycles, lawn furniture).

- Close windows, doors and hurricane shutters. If you do not have hurricane shutters, close and board up all windows and doors with plywood.

- Turn the refrigerator and freezer to the coldest setting and keep them closed as much as possible so that food will last longer if the power goes out.

- Turn off propane tanks and unplug small appliances.

- Fill your car’s gas tank.

- Talk with members of your household and create an evacuation plan. Planning and practicing your evacuation plan minimizes confusion and fear during the event.

- Learn about your community’s hurricane response plan. Plan routes to local shelters, register family members with special medical needs as required and make plans for your pets to be cared for.

- Evacuate if advised by authorities. Be careful to avoid flooded roads and washed out bridges.

- Because standard homeowners insurance doesn’t cover flooding, it’s important to have protection from the floods associated with hurricanes, tropical storms, heavy rains and other conditions that impact the U.S. For more information on flood insurance, please visit the National Flood Insurance Program.

Click Below to read the flood safety checklist, and repairing a flood handbook.

For more information call All American Public Adjusters, Inc at 800.501.1230 for more tips on getting prepared, or email us at info@getclaimhelp.com. It’s important that you get prepared, and fast!

- Published in In the News

MIAMI (WSVN) — Strong storms struck down for the third day as parts of South Florida saw more heavy rain, flooding and hail.

Storms soaked South Florida on Wednesday and once again caused barely visible conditions, flooded streets and an overall soggy afternoon. The storm was so severe that even hail fell from the sky.

Tourist Steve Kelly didn’t think hail could hit down on South Florida. “I don’t believe that there is hail today,” he said. “I’m from Colorado and I don’t think it was cold enough for there to be hail.”

But hail did fall down in some areas during the thunderstorms proving the weather element can occur in warm temperatures. “It was insane. It hailed like the size of marbles and it was hitting hard,” said Arenna Rathjens, who saw the hail.

“I’ve never seen hail in Miami before,” said one man.

In addition to hail, downpour caused street flooding in several neighborhoods from North Miami to Miami Beach to Fort Lauderdale.

In addition to hail, downpour caused street flooding in several neighborhoods from North Miami to Miami Beach to Fort Lauderdale.

The thunderstorms went through Bay Harbor Islands and west to Hialeah.

Back at a restaurant in Brickell, the hail received quite a reception. “And all of a sudden, it started hailing pretty bad and everybody started clapping,” laughed Ozzie Carrillo. “It’s something you don’t see everyday, you know?”

- Published in In the News

As weather disasters strike with more frequency, homeowners first get hit with the destruction or total loss of property. Many are then hit with the unexpected loss of homeowners insurance policies as insurance companies re-evaluate their financial liabilities.

South Florida, last year, R. Paula Lazzari’s home was badly damaged. The retired teacher found broken windows, missing siding and a damaged roof. Her insurer offered to fund repairs for one broken window and some of the siding. It took nine months — and mediation services from an independent adjuster and the Massachusetts Division of Insurance — to get her bills paid, according to the parties involved.

In this era of unpredictable weather patterns, Lazzari’s case is not unique. Insurance companies are raising rates, cutting coverage, balking at some payouts and generally shifting more expense and liability to homeowners, according to reports from the industry and its critics.

“Insurance companies have significantly and methodically decreased their financial responsibility for weather catastrophes like hurricanes, tornados and floods in recent years,” the Consumer Federation of America said in a statement after studying industry data.

The industry concedes that it is trying to avoid getting trounced by those same punishing weather patterns.

“Last year (2011) was an extraordinary year for natural disasters,” said Michael Barry of the Insurance Information Institute (III), an industry trade group. “Insurers have taken a step back to assess whether or not they can absorb severe losses.”

STATES LEFT IN THE COLD

Some insurance companies have pulled out of weather-challenged states — meaning they will not write new homeowners policies and may not renew contracts with current policyholders.

In the wake of Hurricane Irene last summer, for example, Allstate informed some 45,000 North Carolina policyholders that it would not renew contracts that were not bundled with auto insurance.

After a spate of tornadoes last April caused $11 billion of property damage in Alabama, Alfa Mutual Group announced it would not renew 73,000 Alabama property insurance policies.

“The increased frequency and severity of storms over the last decade have highlighted the need for Alfa to review its overall property portfolio,” Alfa President Jerry Newby said in a statement.

Florida, where insurers have been dropping coverage since Hurricane Andrew in 1992, is a good example of where this can lead. With an annual average of $1,460 per home, homeowners’ premiums there are second-highest in the country (Texas, at $1,511 is first), according to the most recent data available, a 2010 report from the Insurance Information Institute.

“Florida’s off the charts when it comes to pricing,” said Mike McCartin, an Ashton, Maryland, independent insurance agent.

The state has stepped in to cover some 1.5 million properties via its publicly funded Citizens Property and Insurance Corporation as insurers drop more and more homes.

“You simply have major private insurers that are unwilling to write policies in Florida,” said Robin Westcott, the state’s insurance consumer advocate.

“It’s just a tough market to be in,” said Phil Supple, a spokesman for State Farm, which was once Florida’s largest property insurer. It stopped writing new homeowners’ policies there in 2007.

CHERRY-PICKING OF CUSTOMERS

Even though companies are not abandoning states at will, many opt to drop coverage on individual homes or customers that may seem prone to file claims. Insurers generally work on three-year contracts with homeowners, Barry said. At the end of those contracts, insurers can decide to raise rates or not renew.

When frozen pipes caused flooding in Phil Berger’s Ijamsville, Maryland, home last year, he got a $6,000 check from Allstate for the damages — and a policy review. Berger said an Allstate contractor told him to make $100,000 in repairs to his home at his expense or he would lose his coverage. He refused, and instead found a less expensive policy with a company that required only one smaller repair before covering the home.

“You just need to be on your toes at all times,” Berger said.

Allstate declined to comment on Berger’s case, but sent an email response to general questions about the company’s nonrenewal policies.

“Allstate responsibly manages its risk by opting to not renew policies as warranted,” company representative Kevin Smith wrote. “These actions are carefully considered, and help ensure Allstate’s continued ability to provide a wide variety of insurance products to consumers at a competitive rate, while remaining financially strong in every community we serve.”

PAYING MORE FOR LESS

Even homeowners that renew every year may find new limits buried in their policies. The Consumer Federation report said insurance companies have “sharply hollowed out the catastrophe coverage offered to consumers” by raising deductibles, capping replacement costs, and — significant for folks in the path of tornadoes and hurricanes — removing coverage for wind damage if another non-covered event (usually a flood) also occurs.

Industry groups say this misstates the facts.

“The …(CFA) could not be more wrong,” said Dr. Robert P. Hartwig, president of the Insurance Information Institute. “Cities such as Tuscaloosa, Birmingham and others are being rebuilt today because of private insurance companies paying losses — not from ‘hollowed out coverage’ policies.” Insurers have paid “literally billions” of dollars to “hundreds of thousands of claimants” affected by natural disasters, he said.

Hartwig also defended the practice by some insurance companies of leaving certain states or regions.

“If you tell an insurance company that they can’t raise rates despite nine hurricanes in two years, obviously insurers are going to have to reduce exposure,” he said.

But homeowners’ insurance premiums have been rising sharply. They have increased an average 6.33 percent annually between 2002 and 2009, according to the National Association of Insurance Commissioners (NAIC). This year, insurers have asked for rate increases of 18 percent or more in 11 states, according to the Consumer Federation.

Robert Hunter, the author of the consumer report, has questioned whether limit-laden policies are worth the rising costs. But mortgage lenders require homeowners insurance, and anyone who has observed a devastating house fire or storm is unlikely to be willing to go without coverage.

COMPARISON SHOPPING

So how can consumers, who have little choice but to keep their coverage, do as Berger suggests and keep on their toes?

Hunter tells homeowners to shop carefully. “Go on your state’s insurance policy website and look for houses similar to yours to compare prices,” he said.

The NAIC provides a map to all state insurance offices on its website, www.naic.org/state_web_map.htm), and provides information about consumer insurance complaints.

Hunter also recommends checking comparison websites such as insuranceproviders.com (www.insuranceproviders.com) or insweb.com (www.insweb.com) for companies with favorable consumer reviews for in your state.

Another step is to get a professional agent to help, said Jim Donelon, Louisiana’s insurance commissioner and president-elect of the NAIC.

“I recommend you talk to as many people as you can. Get an independent agent — someone who’s not attached to a specific company — and get in touch with captive agents but know that captive agents can only represent their company.”

The agents can check to make sure no important coverage — like wind — has been carved out of the policy.

Compare what the agents offer with what you can find online, said Randy Moses, assistant director with the South Dakota Insurance Department.

Even after getting coverage, consumers may find they need extra help. Lazzari needed both an independent broker and a public adjuster to resolve her case. Her insurer, Norfolk Dedham Insurance, not only initially refused to pay for most of her home repairs, but also planned to drop her as a customer, she said. Francis T. Hegarty Jr., president and CEO of Norfolk & Dedham Group, confirmed her version of events, but said it was not unusual for claims such as Lazzari’s to take time to resolve.

Lazzari contacted an independent broker who worked with Norfolk Dedham to successfully complete her home repairs. But the broker said switching insurers would increase her payments 185 percent. That’s when Lazzari contacted the Massachusetts Division of Insurance to find a public adjuster, who eventually persuaded Norfolk Dedham to keep her on its rolls.

“We were eventually able to work things out with Ms. Lazzari,” said Francis T. Hegarty Jr., president and CEO of Norfolk & Dedham Group. “In these kinds of cases with independent adjusters, the claims tend to get strung out and tend to take longer to resolve than they would otherwise. But cases like case are pretty common and, all in all, we’re pleased with how things turned out with her.”

- Published in In the News

In heated legislative battles, it’s common for one industry to be painted as the “villain.” I find it curious that in current debates regarding insurance issues, the villain role is somehow being projected upon those who advocate for you, the people of Florida.

Public insura nce adjusters have played an important role in the Florida insurance industry for more than 60 years. We are licensed and appointed by the state exclusively to represent insured policyholders, helping them navigate the complex insurance claims process in order to receive full and fair compensation from their insurer.

nce adjusters have played an important role in the Florida insurance industry for more than 60 years. We are licensed and appointed by the state exclusively to represent insured policyholders, helping them navigate the complex insurance claims process in order to receive full and fair compensation from their insurer.

When a homeowner’s roof is damaged, we help them secure the claim settlement they need to make repairs. When a water pipe bursts, we help them review their policies to ensure no coverages are missed and that full payment is provided. When a home is destroyed by fire, we help them document the loss according to their policy, to ensure they are fairly compensated.

Apparently, this makes us the bad guys.

We’re being blamed for driving up sinkhole insurance costs, though data provided to the state by insurance companies don’t support this allegation. The vast majority of public adjusters don’t handle sinkhole claims, and about 75 percent of claims are settled without representation by a public adjuster or attorney.

We’re being accused of filing fraudulent sinkhole claims, though the number of claims forwarded by insurers for investigation has fallen to 0.12 percent while the number of claims denied by insurers has more than doubled to 85 percent. Recent news reports have shown that most claims come from areas with previously identified sinkhole activity, that insurers have fought to delay a state database meant to track such activity, and that a state review of sinkhole claims does not factor in the impact of population growth in sinkhole-prone areas.

It has been said that our numbers have grown exponentially in Florida, when according to Department of Financial Service statistics, the opposite is true.

We’ve been told we should no longer be allowed to adjust Citizens Property Insurance claims, just one year after a legislative report showed we have a substantial positive impact on Citizens’ customers.

We’re accused of being “cost drivers,” keeping insurance companies from making a profit, while these same insurance companies are moving huge profits to less-regulated re-insurers that they own and manage.

We follow strict requirements and receive continuing education to maintain our licenses, while non-licensed individuals openly (and illegally) adjust claims.

Our job is to make sure people with valid insurance claims are treated fairly and receive the compensation they are due under the policies for which they’ve paid. We are licensed, bonded and trained to serve as the voice for policyholders. We are the only licensed insurance professionals who advocate for the insured.

If that describes a villain, would someone please tell me, who is the hero?

–

David Beasley is president of the Florida Association of Public Insurance Adjusters, based in Maitland, Fla.

- Published in In the News

Citizens Property Insurance customers would bear more of the cost for excessive damage claims after a major hurricane under legislation that passed the Florida House on Thursday.

Citizens Property Insurance customers would bear more of the cost for excessive damage claims after a major hurricane under legislation that passed the Florida House on Thursday.

The bill, which also is moving quickly through the Senate, shifts more of the burden for post-disaster taxes for excess claims coverage from private property policies to customers of the state-run company. It also gives private companies and their policyholders more time to pay any assessments that are levied.

Limiting assessments on non-Citizens policies could help grow the troubled private insurance market in Florida, supporters of the bill say.

But critics contend that Citizens’ 1.5 million customers — including 10,603 policies in Polk County — are unfairly targeted in the legislation.

Some lawmakers also expressed concerns that largely removing one of Citizens’ post-disaster revenue streams could hurt the company’s finances. Florida’s state-run insurance company could find it more difficult to borrow money if it cannot force private insurance companies to pay their assessments immediately.

“I worry about what happens after a big storm and how this would affect that,” said Rep. Jeff Clemens, D-Lake Worth.

Bill sponsor Rep. Ben Albritton, R-Wauchula, has been quick to point out that Citizens has $6 billion in reserves and $3.5 billion of borrowed cash sitting in the bank. The company also has a large backstop of cash from the Florida Hurricane Catastrophe Fund and private reinsurance.

“This bill does not in any way limit Citizens Property Insurance’s ability to pay claims,” Albritton said in explaining the bill on the House floor this week.

The praise for Citizens’ financial position has not gone unnoticed. Such statements run counter to state leaders’ long-running arguments supporting moves to dismantle the government insurance giant. Gov. Rick Scott and top lawmakers in the House and Senate have asserted that Citizens is a ticking time bomb of liability for state residents and that it will struggle to pay claims after a catastrophic hurricane.

Private insurance companies are eager to eliminate one of the three assessments Citizens is allowed to impose on other companies’ policyholders in the event of a major storm. Their lobbyists and supportive lawmakers have lauded Citizens’ financial health in arguing the post-disaster levy is no longer needed. They note that Citizens has the resources to withstand a repeat of the record-setting 2004-05 hurricane seasons.

Clemens said such optimistic reviews of Citizens’ finances are proof that previous warnings have been overblown. “I think in private moments some of my colleagues will admit that Citizens is in better shape than many of our private insurers,” Clemens said. “Unfortunately, their ideology won’t let them admit that in public so it was refreshing to hear Rep. Albritton come out and say it.”

Albritton said he only mentioned Citizens’ surplus to note that “it takes quite a while to spend $9.5 billion dollars on claims,” so spreading the assessments over a longer time period will not leave the company short on cash.

Citizens has a three-tiered assessment system that kicks in if the insurer runs short of cash. The company’s own policyholders are taxed first, then private policies, then a mixture of both.

The legislation that passed 89-25 in the House would eliminate the second stage of assessments for most homeowners and businesses, and reduce it from 6 percent of a policyholder’s premium to 2 percent for property owners near the coast.

Private insurers do not like the so-called “regular” assessments because they must front the cash to Citizens in a lump sum and recoup the money from policyholders over time.

Insurance companies want all of their assessment to be levied in the third, or “emergency” phase. Private insurers can take longer to collect the assessments from their customers because the companies will not have to pay Citizens up front, and a greater share of the cost will be borne by Citizens’ own policyholders.

Albritton emphasized Thursday that insurance customers “won’t have to pay that assessment year one.”

“They’re going to have an opportunity to spread that out over a longer period of time,” he said. “That is good consumer business.”

- Published in In the News

Although the floods of September 2011 may be a distant memory for many students, many homeowners whose houses were damaged by the flood are still saddled with the financial consequences.

During the September flood, a car sits underwater on Rush Avenue. Many residents did not have flood insurance and were not prepared for the destruction.

Some homeowners in Broome and Tioga Counties were not mandated to purchase flood insurance prior to last September, because local governments delayed implementation of flood-risk maps calculated by the Federal Emergency Management Agency (FEMA). The flood maps, designed to identify areas that face a high risk of flooding, were commissioned after the massive floods of 2006 but took more than three years to complete. The finalized maps would have forced at-risk homeowners to insure their homes.

Thousands of local property owners were warned in 2010 that their homes were within FEMA’s new flood-risk zones, and that they should consider purchasing flood insurance, but because they were not forced to purchase the insurance, many did not.

Those residents ended up with no means to recover from the flood, after the area suffered $1 billion in damages.

Flood maps for the area were supposed to take effect June 16, 2011 but homeowners balked at being forced to purchase flood insurance. As a result, local and state political leaders persuaded FEMA to delay the maps’ re-organization. People whose houses were located in flood-risk areas, and whose houses were federally insured or financed, would have been forced by their mortgage company to buy flood insurance.

With about 100,000 households in the area, only 3,397 flood insurance policies were in place by Nov. 30, 2011, according to federal flood insurance data for Broome and Tioga Counties. State and local inspection agencies determined that 5,318 properties were damaged and 21 of them were destroyed.

Kellie Duff, a flood victim and secretary for Binghamton University’s Center for Learning and Teaching, said she was discouraged from buying flood insurance because she was not in a mandated flood zone. She was told by an insurance agent that she could purchase costly insurance, but her home would most likely not be affected.

Mike Morosi, a spokesman for Congressman Maurice Hinchey (D-NY) who represents parts of Broome County, said that the congressman tried to balance the need for flood insurance in case of disaster with the financial pressure incurred by mandating insurance.

Morosi said that individuals could pay for flood insurance over a five-year period to make the cost more manageable.

“He [Hinchey] supported a plan that would’ve faded in the cost of purchasing flood insurance over a five-year period while at the same time maintaining the requirement that those who FEMA has determined lived in a very flood-risk area would still have to purchase insurance,” Morosi said.

This policy would effectively allow homeowners to purchase the flood insurance later, even if their houses were in a flood-risk area, according to Morosi.

FEMA determines flood-risk zones, while individual agents from insurance agencies, such as State Farm, handle dispensing the insurance to individual homeowners. FEMA requires close cooperation with the local government in order to create, approve and institute the flood maps. However, the local government, not FEMA, is responsible for mandating individuals to buy the insurance.

Alan Springett, a FEMA senior risk assessment lead engineer for Region II, which encompasses Broome County, discussed the need to work with local communities and government to analyze past data and produce the maps.

“We prioritize in conjunction with the state, the state is always our partner, and so are local communities,” Springett said. “We look at what are the losses that we’ve seen in the past. We look at what are the complaints that we have heard about flooded in areas. And then we try to prioritize where the funding is needed to better identify the risk of floods.”

Springett attributes the responsibility to local community governments.

“FEMA may provide them and produce them, but it is a local map, it is a local responsibility,” Springett said. “It is their law and ordinance that we are assisting them in creating to protect their citizens. They have to live with these maps, we don’t.”

Jim Rollo, a State Farm insurance agent in Endwell, a suburb of Binghamton, said he thought that while the local government should be blamed for not enforcing the maps, some of the blame lands on the individual.

“If you’re an advocate of personal responsibility, you could say that the 7,000 property owners in Broome County who received a letter in March of 2010 advising them that their property was going to be zoned into a flood zone … they made a decision to purchase flood insurance or not,” Rollo said.

Many victims of the flood lost everything. Rollo said many of his clients were retired seniors who had already paid for their houses, which served as their largest asset. Rollo said people could have bought a $300 policy that would have saved their house.

Rollo also said that many people who had their houses condemned still had to pay their mortgage, piling on their economic woes.

Carol Doty, a secretary in the Office for Student Conduct at Binghamton University, had a house in Endicott that was damaged by the flood.

Doty said her floor was covered in four inches of water, her furniture was ruined and her basement was flooded, forcing her to live with friends for a while. She had not bought flood insurance, she said, because after the 2006 flood, she did not think there would be another severe flood.

She has since sold the house and moved to an apartment less prone to flooding. She said she thinks the government could do more to prevent homeowners from going through what she did.

“I think maybe they shouldn’t allow you to build houses there, and if they do then they should make you buy flood insurance,” Doty said.

Doty and other homeowners were given aid by FEMA and other charities to recover from the flood.

- Published in In the News

After the storm, besides making temporary repairs, there are several steps you should take that will aid in the filing of an insurance claim.

Call All American Public Adjusters, Inc before you do anything! We can help guide you through this difficult time and process.

Make temporary repairs

- Make temporary repairs to prevent further weather related damage. Cover holes in the roof, walls, doors and windows with plastic or boards. Be careful not to risk your own safety in making the repairs.

- Save receipts for any material you buy. Your insurance company will reimburse you for the cost.

- Beware of building contractors that encourage you to spend a lot of money on temporary repairs. Remember that payments for temporary repairs are part of the total settlement. If you pay a contractor a large sum for a temporary repair job, you may not have enough money for permanent repairs.

- Don’t make extensive permanent repairs until after the claims adjuster has been to your home and assessed the damage.

- Avoid using electrical appliances, including stereos and television sets, that have been exposed to water unless they’ve been checked by a technician.

Call your insurance agent or insurance company

- Report the damage to your insurance agent or insurance company representative. Ask questions such as: Am I covered? Does my claim exceed my deductible? (Your deductible is the amount of loss you agree to pay yourself when you buy a policy.) How long will it take to process my claim? Will I need to obtain estimates for repairs to structural damage?

Save receipts for additional living expenses.

- Most homeowners policies cover additional living expenses such as food and housing costs, telephone or utility installation costs in a temporary residence, extra transportation costs to and from work or school, relocation and storage expenses and furniture rental for a temporary residence. Your insurance company will usually advance you money for these expenses. The payments will be part of the final claim settlement. Let your insurance company know where you can be reached so that the claims adjuster can give you a check.

- The maximum amount available to pay for such expenses is generally equal to 20 percent of the insurance on your home. So on a home insured for $100,000, up to $20,000 would be available. This amount is in addition to the $100,000 to pay for repairs or to rebuild your home. Some insurance companies pay more than 20 percent. Others limit additional living expenses to the amount actually spent during a certain period of time, such as 12 months, instead of a maximum percentage of the policy limit.

Preparing for the adjuster’s visit

The claims process may begin in one of two ways.

- Your insurance company may send you a claim form, known as a “proof of loss form,” to complete.

- An adjuster may visit your home before you’re asked to fill out any forms. (An adjuster is a person professionally trained to assess the damage.) Usually, the more information you have about your damaged home and belongings the faster your claim can be settled.

- Major disasters make enormous demands on insurance company personnel. Your adjuster generally will come prepared to do a thorough and complete study of the damage to your home. However, the large number of claims may place time restrictions on adjusters forcing them to “scope the loss.” If your adjuster doesn’t make a complete evaluation of the loss on the first visit, try to set up an appointment for a second visit.

- Be sure to keep copies of lists and other documents you submit to your insurance company. Also, keep copies of whatever paperwork your insurance company gives you.

Personal Belongings:

- Make lists of the damaged items. Include the brand names and model numbers of appliances and electronic equipment. If possible, take photographs of the damage. Don’t forget to list items such as clothing, sports equipment, tools, china, linens, outside furniture, holiday decorations and hobby materials.

- Use your home inventory or put together a set of records – old receipts, bills and photographs – to help establish the price and age of everything that needs to be replaced or repaired.

- If your property was destroyed or you no longer have any records, you will have to work from memory. Try to picture the contents of every room and then write a description of what was there. Try also to remember where and when you bought each piece and about how much you paid.

- Don’t throw out damaged furniture and other expensive items because the adjuster will want to see them.

Structure of Your Home:

- Identify the structural damage to your home and other buildings on your premises, like a garage, toolshed or in-ground swimming pool.

- Make a list of everything you would like to show the adjuster when he or she arrives. This should include cracks in the walls, damage to the floor or ceiling and missing roof tiles. If structural damage is likely even though you can’t see any signs of it, discuss this with your adjuster. In some cases, the adjuster may recommend hiring a licensed engineer or architect to inspect the property.

- Have the electrical system checked. Most insurance companies pay for such inspections.

- Get written bids from reliable, licensed contractors on the repair work. The bids should include details of the materials to be used and prices on a line-by-line basis.

Public Adjusters:

- Your insurance company provides an adjuster at no charge to you. You also may be contacted by adjusters who have no relationship with your insurance company and charge a fee for their services. These are known as public adjusters. You may use a public adjuster to help you in settling your claim.

- Public adjusters may charge you as much as 15 percent of the total value of your settlement for his or her services. The fee isn’t covered by your insurance policy. Sometimes after a disaster, the percentage that public adjusters may charge is set by the insurance department.

- If you decide to use a public adjuster, first check his or her qualifications by calling your state insurance department. Call All American Public Adjusters, Inc!

- Published in In the News

There is a lot of conflicting information on the internet concerning public insurance adjusters. Some resources advocate their services, whereas others say hiring them is not crucial and will leave you with less money. It is important to do your homework and separate fact from opinion in order to determine the truth.

There is a lot of conflicting information on the internet concerning public insurance adjusters. Some resources advocate their services, whereas others say hiring them is not crucial and will leave you with less money. It is important to do your homework and separate fact from opinion in order to determine the truth.

In a nutshell, public adjusters are licensed insurance claims professionals that appraise damage, prepare written estimates/documentation, and negotiate settlements on behalf of the homeowner. The difference in opinion seems to be whether or not they are worth hiring. To answer this question, we can take a look at the statistics from an independent study.

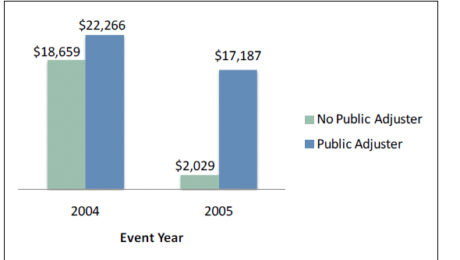

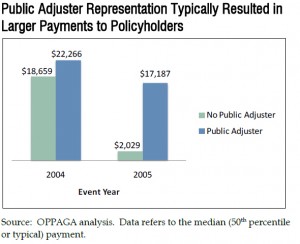

To evaluated the impact of public adjusters on insurance claims, the Office of Program Policy Analysis & Government Accountability conducted an independent study on claims from Florida’s Citizens Insurance Company. The study answers a very important question about Florida public adjusters: What are the outcomes on claims processing and payments when using a public adjuster?

During the 2004/2005 hurricane season, over 300,000 homeowner insurance claims were filed with Florida’s Citizens Insurance Company. The majority of these claims were settled between the insurance company and the homeowners. However, a small portion of claims were settled using public adjuster representation.

For this study, over 76,000 claims were examined (approx 61,000 non-catastrophe and 15,000 catastrophe claims). After careful analysis, it was determined that policyholders with public adjuster representation typically received higher settlements than those who didn’t use them. If we look at claims related to the 2005 hurricanes, they achieved settlements that were (on average) 747% higher than those without representation. The study also shows more than half the catastrophe claims were re-opened by public adjusters to get clients additional compensation for their loses. This is further proof that public adjusters can get higher settlements for their clients.

If we use the figures above, the difference in settlement would be as follows:

SCENARIO A (A Homeowner with no Representation)

A homeowner experiences damage as a result of a storm, and files a claim with their insurance company. After the company adjuster visits the homeowner and appraises the damage, they give a settlement of $10,000 for the damages/loses to the homeowner

SCENARIO B (A Homeowner represented by Public Adjuster)

The same homeowner decides to hire a public adjuster, instead of trying to settle it on their own. After they appraise the damage to the home and submit the documentation for the claim, the homeowner receives a settlement of $63,495 (after a 15% fee [FL state average] paid for the adjuster’s services)

Conclusion

Although some might argue against the use of Florida public adjusters, statistics show they get larger settlements than those who do not use their services. This is especially noticeable with catastrophe insurance claims. The only question now is whether you want to risk a significant portion of your settlement by going against the odds and not hire one.

Article Source: http://EzineArticles.com/6590340

[footer1]

- Published in F A Q, In the News