Are you covered by your homeowner’s insurance?: fox10tv.com

Angie’s List

Your home is a big investment and it’s an investment you want to protect. But when was the last time you reviewed your homeowner’s insurance coverage?

A nationwide Angie’s List poll found:

96% have homeowner’s insurance

Nearly 30 percent of respondents to a nationwide Angie’s List poll said it’s been two years or more since they reviewed their coverage with their agent.

Homeowner’s insurance is designed to protect damage from specific weather disasters, fire, theft, injuries, etc. You must then buy separate policies for floor and earthquake coverage.

Angie’s List, the nation’s leading provider of consumer reviews, asked highly rated insurance agents about homeowner’s insurance coverage.

10 tips to help homeowner’s get proper coverage:

Annual review: When you get your renewal notice, talk to your agent about whether you need to adjust your coverage. Update your policy if you have added square feet, remodeled, bought expensive items like jewelry/artwork/electronics, added a pet, boat, changes in your household, etc. Determine whether you have adequate liability insurance to protect yourself if someone is injured on your property. Consider increasing your liability protection if you install a pool, etc.

Get what you need: Replacement cost insurance covers the cost of replacing your home and is generally the policy for most homeowners. Your agent will evaluate your home and its contents and write a policy that would replace it at that value.

Get specific. Find out what your policy says about storm, water, mold, wind and flood coverage. In the past 10 years, companies have increasingly changed the language about these specific items. Ask about adding specific endorsements if your agent or company doesn’t offer the coverage you want.

Flood warning. If you live in a low-lying area or one that is predisposed to flooding, purchase flood insurance from the National Flood Insurance Program.

Get loss of use coverage. Consider loss of use insurance to cover rent or hotel fees in the event your home is uninhabitable after a catastrophe. Experts recommend at least one year of coverage.

Claim deadline. Check with your state’s Department of Insurance for the statute of limitations for filing a claim, which can vary from one to two years.

Safe keeping. Put important paperwork, especially policy information, in a fireproof/waterproof safe. Take photos and videos of everything in your home. Keep the originals in a safe-deposit box and send copies to relatives or friends across the country.

Ask around. Don’t take an insurance adjuster’s proof-of-loss statement as accurate. Instead, use at least three independent contractors’ estimates as your starting point. The insurance company’s initial payout is often drastically lower than what the work will require.

Public adjuster. If you experience a sizable loss, consider hiring a public insurance adjuster who will file and submit your claim on your behalf. These adjusters often have years of experience on the private insurance side and work to get homeowners the best settlement possible. Their compensation is a percentage of your settlement. That percentage varies by state.

Crash course. Familiarize yourself with what you are entitled to receive in the event of a loss. Ask your agent about his or her experience in handling a loss claim. An experienced agent should be able to not only detail what your policy will and will not cover, but be able to give you a good idea of what to expect if a claim takes place.

Angie’s List Tips to get the best deal:

Improve your home’s safety: Severe weather, higher rebuilding costs and an increase in claims can all affect the price of your premium. Some companies offer discounts for installing storm shutters, adding a security system, updating wiring, or your home’s proximity to a fire station.

Bundle up: Many companies will reduce your rates if you purchase additional policies, such as auto or life, through them.

Raise your deductible: Just remember if you do have a claim, you are going to have to pay more out of pocket then you would have before.

Shop around: Like any other service, shop around for homeowner’s insurance rates. You can comparison shop online with just a click of a mouse. Comparing policy coverage options with a few companies will give you the opportunity to find the best policy at the best price.

- Published in In the News

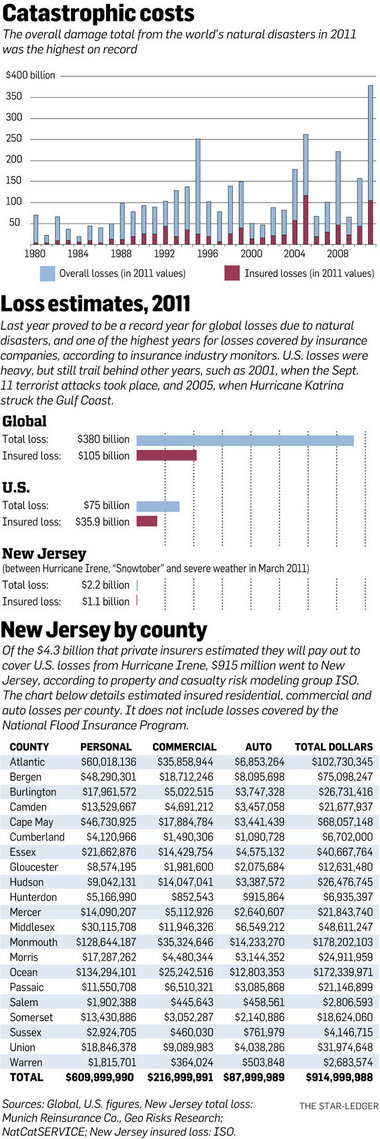

New Jersey homeowners and business owners should expect to feel the effect of Tropical Storm Irene for years to come, insurance industry representatives and analysts say.

Private insurers are in the midst of shelling out roughly $915 million to cover damage from the storm in the state alone, according to the latest estimates by ISO, a Jersey City-based insurance risk advisory group. These insured losses, along with roughly $150 million to cover October’s freak snowstorm and $21.8 million for a string of severe weather last March, will be factored into the rate reviews that insurance companies make over the coming years, industry analysts say.

All told, the three events sapped nearly $1.1 billion from private insurers, making 2011 the costliest for New Jersey underwriters in ISO’s records. By comparison, New Jersey’s insured losses in 2010, which saw a devastating March nor’easter, were $486.7 million, said ISO, a leading provider of data on property and casualty insurance risk.

Though no single event sets the price of insurance, the rising toll of covering catastrophes in the state, across the nation and around the world will be reflected in rising premiums to come, industry watchers say.

“When companies experience high catastrophe losses in a certain region, they have to raise prices to recover their margins,” said Jimmy Bhullar, an insurance analyst at JPMorgan Chase.

Robert Hartwig, president and economist of the Insurance Information Institute, estimates that catastrophes will push the most common homeowner premium this year past the thousand-dollar mark.

U.S. homeowners on average paid $880 for the most common policy in 2009, according to data released this month by the National Association of Insurance Commissioners. Hartwig notes that prices have continued to rise for subsequent years and projects that nationally, the most common policy in 2012 will cost on average $1,004. Historically, New Jersey’s homeowner premiums have trailed U.S. averages.

Spokespeople for the state’s top home insurers said it’s too early to tell how last year’s storms will impact rates in New Jersey, and the state Department of Banking and Insurance, which approves rate changes in the state, is not anticipating increased requests to raise premiums due to last year’s storms, a spokesman for the regulator said.

But insurance executives have that warned higher rates are coming. Two-thirds of the executives who responded to a recent Insurance Information Institute survey said they expect premium growth in 2012, which can mean a combination of attracting new policyholders and raising rates on existing ones.

Tom Wilson, chairman and CEO of Allstate, told attendees at a Goldman Sachs-sponsored conference in December that large catastrophe losses of recent years have weighed on company profit. One way it is responding is to raise prices “dramatically,” Wilson said: 9 percent in 2009, 8 percent in 2010 and 6 percent through the first nine months of 2011.

“Raising price obviously brings in more money, which covers those increased costs,” he said.

Dino Robusto, president of personal lines and claims at Chubb, the Warren-based insurer, said on a call with analysts in October that the company has received approval to increase homeowner rates by 3 percent to 4 percent in key states “and we anticipate filing for additional rate increases as needed.”

Shared Pain

The world has seen an explosion of natural disasters in recent years, but the catastrophes that struck last year made 2011 the costliest on record both globally and in New Jersey. The tsunami-sparked meltdown of the Fukushima nuclear plant in Japan, flooding in Thailand and earthquakes in New Zealand were among 820 events around the world that caused, collectively, about $380 billion in damage, of which $105 billion was borne by insurance companies, according to Munich RE, one of the world’s largest providers of insurance to insurance companies.

href=”https://www.getclaimhelp.com/?attachment_id=597″ rel=”attachment wp-att-597″>

Overall damages in the United States last year paled in comparison to 2005, when Hurricanes Katrina and Rita punished the Gulf Coast and contributed to nearly $200 billion in total losses. But Irene, the deadly tornado in Joplin, Mo., and a record drought in Texas pushed the U.S. tally to about $75 billion of the world’s total losses, said Munich RE, whose U.S. headquarters are in Princeton. Of that, $35.9 billion was privately insured.

Irene alone is estimated to have cost the United States about $10 billion, of which $4.3 billion was covered by private insurers, Munich RE and the Insurance Information Institute have found.

The insured losses from Irene do not include claims covered by the federal National Flood Insurance Program. About $703.5 million has been approved for claims rising out of Irene, according to the Federal Emergency Management Agency, which administers the flood insurance program. Of that, $249.4 million went to New Jersey claims, FEMA said.

Private insurers that underwrite policies in New Jersey took the brunt of the storm, estimates from ISO show. They absorbed about 21 percent of the insured losses from Irene, which struck 13 states and Washington, D.C. The carriers are paying more than three times what the federal government has paid for flood insurance claims so far. Every county in the state reported seven-figure losses to private insurers, from $2.7 million in Warren County to $178.2 million in Monmouth County, said ISO.

Catastrophe Hit

The losses have eaten away at balance sheets. Last year, the property and casualty insurers paid $1.08 for every $1 they received in premiums, according to data from the Insurance Information Institute. That is the highest such ratio since 2001, and it is due to high catastrophe losses, dwindling reserves and the toll of the soft market, the institute said.

During the first nine months of 2011, private U.S. property and casualty insurers saw their net income dive to $8 billion from $27.1 billion during the same period in 2010, a 70 percent plunge, according to a joint study by ISO and the Property Casualty Insurers Association of America. Most of that was due to losses from major catastrophes, the groups wrote in a Dec. 27 release.

Chubb was among those hard-hit by Irene. Its third-quarter profit, reported in October, dropped 48 percent owing largely to catastrophe losses. Chubb in 2010 was New Jersey’s fourth-largest home insurer by market share, according to DOBI.

An Alternate Model

As punishing as 2011 was to insurers, individual catastrophes on their own do not drive up the cost of property insurance, companies and industry representatives say. Rather, companies use catastrophe risk models that assess disasters over many years and alongside other factors such as construction costs and commodity prices, which impact, for example, the cost of replacing asphalt, aluminum siding or copper pipes.

Some companies do not factor in actual claim experience from massive storms but use historic averages instead in order to smooth out spikes, said Deana Lykins, president of the Insurance Council of New Jersey. “This has the effect of dampening the impact of any individual event on the rate-setting process,” she said.

Yet insurance companies are reassessing their use of catastrophe-risk models, and the models themselves are changing after they failed to predict the toll of recent disasters, said Bhullar of JPMorgan.

Hartwig of the Insurance Information Institute said he expects the enormous impact of natural disasters last year, both in the United States and abroad, to drive rate increases in the years to come, even though the industry as a whole remains very well-capitalized.

He did not have a projection for New Jersey homeowner rates but said dwellers in coastal and high-value areas, as well as those hit hard by Irene, should expect to see their rates hiked. New Jersey homeowners have paid less than the national average, or $848 for the most common premium in 2009, according to the most recent NAIC data.

Rates in Check

Chris Hackett, director of personal lines policy for the Property Casualty Insurers Association, agreed that consumers in disaster-swept areas should expect to see a rise in rates. “It does come down to claims data in specific geographic areas,” he said.

But a number of global factors will keep rates in New Jersey from rising too high, insurance regulators say.

Most of New Jersey’s carriers were not directly exposed to catastrophic losses from around the world, said Marshall McKnight, a spokesman for the state’s banking and insurance regulator. Meanwhile the cost of reinsurance, the coverage that insurers buy to protect themselves and a factor in pricing premiums, has remained low, he said.

Mike Chaney, Mississippi’s insurance commissioner and chairman of NAIC’s property and casualty insurance committee, said the despite the “wishful thinking” of insurance company CEOs for higher premiums, other factors in the global economy will conspire to keep rates from rising too high. For example, low interest rates have made the reinsurance market an attractive place to park capital, which in turn will keep rates low, he said.

State regulators also have the ability to deny rate increases submitted for their approval if they are not adequately justified.

State Farm — New Jersey’s largest home insurer by market share, according to DOBI — last year in New Jersey handled 21,000 homeowners’ claims and another thousand automobile claims tied to catastrophe, said spokeswoman Arlene Lester. Yet the insurer, which has received rate increases averaging more than 6 percent nationwide over the last three years, is “not anticipating at this moment” a rate increase in light of claims being paid out, she said.

Allstate, the state’s second largest home insurer by market share, had a 5.9 percent increase in its homeowner rates in December, but the rate was filed before Irene and did not reflect losses from the storm, said spokesman Daniel Jovic.

A spokesman for New Jersey Manufacturers Insurance Co., the state’s third-largest home insurer by market share, said it is too early to tell what effect the disasters of the past year will have on rates. But the cost already has been tremendous. The mutually held company expects to pay out $76 million to cover home and auto claims from Irene, the costliest event in its near-century history, said spokesman Patrick Breslin. Its second- and third-most costly events were the March 2010 nor’easter, which cost $25 million, and October’s snowstorm, which tapped an estimated $13 million, he added.

But as large as Irene was, NJM did not have to call upon its reinsurance to help it cover claims, Breslin said. “We have prepared for catastrophes like this.”

- Published in In the News

It’s the Great Florida Sinkhole Lottery and the payouts are big in Hernando County.

It’s the Great Florida Sinkhole Lottery and the payouts are big in Hernando County.

A Spring Hill couple notices cracks creeping across the floors of their home. They claim sinkhole damage and their insurance company cuts them a check for $206,000.

A widower returns from his wife’s funeral to find one room filled with water and a 2-inch gap between floor and door. He files a sinkhole claim and gets $211,000.

And a retiree from New York puts in a claim after his insurer says it plans to drop sinkhole coverage. He gets $260,000.

Insurance companies forked out more than a half-million dollars on these three houses alone, but the cracks and gaps are still there. None of the owners used the money to make repairs.

The house “can fall in the ground for all I care,” said retiree John Backer, who invested his $260,000 payout. “I made my money already.”

According to an investigation by the Tampa Bay Times, Backer is among hundreds of Floridians — especially those in the “sinkhole alley” of Hernando, Pasco, Hillsborough and Pinellas counties — who have paid off mortgages, put in pools, replaced roofs or otherwise used money from sinkhole claims to do something besides fix sinkhole damage.

The result: Homes from Brandon to Port Richey to Weeki Wachee sit unrepaired, decimating property values and draining millions of dollars in tax revenue from local governments already hard hit by the recession.

Since 2005, the Florida Legislature has repeatedly tried to find ways to ensure that legitimate sinkhole damage is covered and repaired while cutting down on the number of questionable claims. The latest attempt came in May with major changes to state law that require homeowners to repair damage and that make it less attractive to sue their insurance companies.

But despite all of the tinkering in Tallahassee, what lawmakers call “Hurricane Sinkhole” still roars unabated.

• The number of residential sinkhole claims filed with Citizens Property Insurance Corp., which insures more Florida homeowners than any other company, has nearly tripled in the past five years, from 1,482 claims in 2007 to 4,024 last year. The average claim now costs Citizens nearly $90,000. In 2010, the last year for which figures are available, the state-run company said it took in $32 million in premiums but incurred $245 million in sinkhole losses.

Soaring losses mean higher premiums for all of Citizens’ nearly 1.5 million policyholders, not just those in sinkhole-prone areas. Even homeowners who have policies with private insurers would be liable for a 6 percent surcharge.

• Citizens has contributed to its losses by opting in some cases to handle the sinkhole repairs itself.

Homeowners complain that contractors hired by Citizens do shoddy work, leading to lawsuits and settlements that can run into six figures. Citizens shelled out more than $350,000 in repairs, legal fees and settlement costs on a Hernando County house with a market value of just $39,500.

• Aggressive marketing by lawyers, contractors and public insurance adjusters drives up costs by encouraging homeowners with even minor cracks to file claims and, in many cases, sue.

The payoffs can be great — the public adjuster, who works for the homeowner, typically gets 10 percent of any insurance settlement while the lawyers walk away with up to 40 percent.

• Collusion among unscrupulous engineers and contractors costs insurers hundreds of thousands of dollars.

A contractor who worked closely with a well-known Brooksville sinkhole repair company faces felony charges of insurance fraud in what State Farm Insurance says was a conspiracy to inflate the cost of grout used to fill sinkholes under dozens of houses in the Tampa Bay area.

• Critics say Florida’s new sinkhole law is so flawed that there will be more, not fewer lawsuits against insurance companies.

And because the law exempts homeowners who sue and settle from the requirement to make repairs, houses with unrepaired sinkhole damage will continue to be a drag on property values and tax collections.

Stampede of claims

No one denies that Florida is prone to sinkholes.

Heavy rains, massive pumping of groundwater and other factors can speed sinkhole formation, but Florida’s Swiss-cheese geology and sandy soil have remained the same for eons. Thus no natural events explain the explosion in sinkhole claims in the past five years.

And nowhere has that explosion been greater than in Hernando County.

In a 2002 study by the insurance industry, Hernando wasn’t even listed among the seven Florida counties with the highest number of sinkhole claims. A decade later, Hernando leads the state.

“The incidence of claims is generally driven by the awareness of sinkholes or some type of scare tactics or advertising to homeowners saying, ‘You’ve got coverage now, you may not have coverage later so if you have a claim file it now,’ ” said George Sinn, a geotechnical engineer who works for both insurers and homeowners. “So you get people who are used to living with typical small hairline cracks filing claims.”

In 2005, Citizens received 113 sinkhole claims from Hernando. In the year just ended, there were 1,920 — more than twice as many as runner-up Pasco.

As the number of claims has soared, the value of Hernando homes and businesses has plunged. With nearly 3,000 owners since 2005 requesting an adjustment in values because of sinkhole activity, Hernando County Property Appraiser Alvin Mazourek pegs losses to the county’s market value at a staggering $283 million.

“Sinkholes do exist and the impact of such can be quite devastating, not to mention dangerous,” Mazourek wrote to a state lawmaker before the 2011 legislative session.

“But unfortunately . . . it seems that while the general public is now very quick to have the problem diagnosed, the desire to remedy the problem is not being met with the same urgency and more often than not, goes completely unrepaired.”

Mazourek wasn’t exaggerating.

Under state law, any insurance company that pays a sinkhole claim is supposed to file a notice with the clerk of court. The Tampa Bay Times looked at 593 notices Citizens filed in Hernando in 2008, 2009 and 2010, the years for which the notices clearly stated that a claim had been paid. (The forms changed in 2011.)

Of the 593 homes for which Citizens made payouts, county building records show no evidence that 282 were ever repaired — nearly half of the total.

Island of cement

The experiences of two Hernando County families insured by Citizens help explain why there are so many unrepaired houses and big insurance payouts.

Ronald Kotecki knew little about sinkholes when he and his wife moved from California to Spring Hill in 2004. Then water seeped into a back bedroom from a crack in the slab foundation.

Kotecki asked the foreman of a construction crew working nearby to take a look. Instead, the foreman sent over a public adjuster, a licensed insurance adjuster who works on behalf of the homeowner instead of the insurance company..

“He’s there five minutes and said, ‘You got a sinkhole,’ ” Kotecki recalled. “He said, ‘It’s not going to cost you anything.’ ”

When Citizens denied their claim, the Koteckis sued. They settled for around $217,000, the limit of their policy, with the lawyer taking a third, the adjuster 10 percent and the Koteckis the rest. They considered making repairs until the adjuster pointed out that there are companies that buy unrepaired sinkhole homes.

So instead of stabilizing the sinkhole and fixing the cracks, estimated to cost $300,000, they paid off their mortgage and other debts and sold the house for $190,000.

Six years and two owners later, that house remains unrepaired.

The Koteckis moved to another home in Spring Hill that also developed sinkhole-related problems. This time Citizens invoked its right under the Koteckis’ policy to make the repairs itself. It hired a contractor to stabilize the hole with grout at a cost of about $150,000, Kotecki said.

Citizens also wanted to be in charge of cosmetic repairs, which included painting, replacing a tile floor and installing pavers in the driveway and pool areas.

“That started taking forever,” said Kotecki, a retired magazine sales representative. “People weren’t showing up. When you’ve got a heart condition you don’t want all that stress.”

The Koteckis sued Citizens again, eventually settling for $117,000. After the lawyer and public adjuster took their cuts, the Koteckis were left with enough to make some but not all of the cosmetic repairs. New cracks already are appearing.

Still, “I feel a lot more comfortable when sitting on $150,000 of cement and grout,” Kotecki says. “You’re pretty much on an island of cement.”

Citizens’ odd logic

Judith and James Pierce are sitting on a lot of cement, too. But they’re not happy.

There are two main ways to fix sinkhole problems — stabilizing the hole with tons of grout, a cement-based material, or securing the house with steel pins or piers drilled deep into the ground. Engineers often recommend both methods to reduce the odds of the house developing future problems.

So the Pierces called a lawyer when Citizens, invoking its right to repair, chose to do grouting only, followed by cosmetic repairs.

“The lawyers said, ‘Let them do whatever they want and don’t say anything because they’ll screw up and then we can sue them,’ ” Judith Pierce, 53, recalled. “It’s a big game.”

Sure enough, there were problems. Newly installed pavers raised the floor level in the sun room so much the sliding doors to the pool didn’t work. A hot tub was left sitting outside so long that rats chewed through the wiring. Painting was sloppy.

The Pierces sued Citizens. They settled for $133,000, of which they got $71,000 after the lawyers and a public adjuster took their shares. A judge awarded the lawyers an additional $123,000.

Judith Pierce tallies what Citizens spent: At least $110,000 for grouting and inferior repairs followed by the settlement and extra attorney’s fees. A total of $366,000 for a house that the Pierces had on the market for three months and got one offer: $20,000.

Citizens won’t comment on matters involving individual policyholders. The company said it stopped its “election to repair” program in 2010 although it still considers handling repairs itself on a case-by-case basis.

Unintended effects

The Times analysis of Citizens’ paid claims in Hernando County found that 124 of the 593 policyholders who got payouts subsequently sued Citizens — one out of every five.

And of those who sued, 40 percent have never made repairs.

“Some of my colleagues have suggested that the largest expansion of gambling in the state of Florida has been with Citizens,” says Sen. Garrett Richter, a Naples Republican and chairman of the committee that pushed for Senate Bill 408 with its radical changes to sinkhole insurance in 2011.

The new law is supposed to reduce the number of claims and lawsuits in several ways:

• If an insurer denies a claim without testing for a sinkhole, the homeowner must pay up to $2,500 for testing if he wants to appeal. (The insurer refunds the money if a sinkhole loss is found.) Before, the homeowner could demand testing and not have to pay for it.

• Insurers don’t have to pay for below-ground stabilization until the homeowner contracts to have the work done according to recommendations in the insurer’s engineering report.

• Benefits are restricted to “structural damage” of the principal building (typically the house), and the definition of damage is now based on Florida construction and engineering codes.

“Structural damage really wasn’t defined very tightly in the statutes at all,” said James Knudson, a Senate attorney who helped draft the bill.

While some insurers said the damage had to be severe enough to affect a home’s structural integrity, attorneys for homeowners argued that it simply meant the structure was damaged. “You can see a huge difference between those two things,” Knudson said.

Critics say the new law hurts policyholders.

“Once that bill got in the hands of lobbyists, it created a lot of push to do anything that would discourage valid claims,” said Ted Corless, a Tampa lawyer who once represented State Farm and now represents homeowners. “It’s one giant mashed potato.”

Corless predicts the changes will lead to more litigation, not less. If so, the number of unrepaired houses could climb. Homeowners who settle a lawsuit with their insurers are exempt from a requirement that they use the money to stabilize the sinkhole.

“If you reach a settlement, then you’re outside of the sinkhole statute” and don’t have to make repairs, Knudson acknowledged.

The full impact of changes in the law won’t be known until all current policies are up for renewal. Insurers can now require an inspection at the homeowner’s expense before writing sinkhole coverage.

“We got one house approved (by Citizens) and it was an older home, but it was in pristine condition,” said Karen Lund, an agent with Whiting Insurance in Spring Hill. “We have two others in review, but in talking to other agents, they’ve gotten more declines than approvals.”

The likely result? Homeowners will complain and Florida lawmakers will continue to tinker. And that could scare even more homeowners into thinking they need to get in a claim before the law changes yet again.

A cheaper way

That’s what happened with Amy and Freddy Blackburn.

When it became a “tug of war” to open the French doors at their Spring Hill home, the couple suspected a sinkhole. Fearing the Legislature might let insurers drop sinkhole coverage, Amy Blackburn, the owner of record, filed a claim with Citizens. She sued after Citizens said it intended to have the hole filled with $150,000 worth of grout.

“We didn’t want grout,” Freddy Blackburn said. “You start putting grout in the ground, what’s that grout going to do to the environment?”

Citizens settled, and the Blackburns used the money to install steel piers for about $45,000. They wonder why Citizens didn’t consider that much cheaper fix.

“Even if you spent $4,000 or $6,000 on another opinion, you’re still $94,000 ahead,” Freddy Blackburn said. “That concerns me they didn’t try to find another option. That’s why they have to raise rates. Can you imagine getting $3,000 on a policy in premiums and then paying out $150,000 on sinkhole claims?”

Times researcher Carolyn Edds contributed to this report. Susan Taylor Martin can be reached at susan@tampabay.com. Dan DeWitt can be reached at dewitt@tampabay.com or (352) 754-6116.

A landslide of claims

Number of residential sinkhole claims filed with Citizens has been on the rise.

[footer1]| 2007 | 2011 | |

| Hernando | 421 | 1,920 |

| Hillsborough | 216 | 665 |

| Pasco | 653 | 888 |

| Pinellas | 85 | 237 |

| Statewide | 1,482 | 4,024 |

- Published in In the News

SPRINGFIELD, Ill. (AP) — Diane Hopp says she doesn’t have a green thumb, so if her neighbors were around, they might be surprised to see her spraying a garden hose — particularly in December inside the living roo m of a newly renovated home.

m of a newly renovated home.

“It really bothers me to see all this mess, and that we did it,” she said.

The insurance agent from Petersburg, Ill., was one in a line of hose-wielders helping christen the small, frame structure on the edge of downtown Springfield — fondly nicknamed “flood house” — as part of an unusual experiment to assist the untold thousands who bemoan indoor flooding from the showers of spring and the burst pipes of winter.

The owner of the house, Peerless Cleaning and Restoration Services, says it is one of just a few “flood houses” it knows about. The company intends to flood it twice a month to help insurance agents know better what to do when a client calls, real estate agents more readily spot long-ignored problems that spawn mold, and eventually would-be technicians in learning to run vacuums and moisture meters.

The company promised that within days the custom rebuilt structure — outfitted with its own industrial strength sprinklers and spigots sticking out of the walls — would be bone-dry and ready to be doused again for the next demonstration.

Michael Barry, a spokesman for the Insurance Information Institute, said Americans generally underestimate the chances they’ll be hit by unwelcome water. He said he hadn’t heard specifically of “flood houses,” but applauded efforts to teach homeowners and agents what’s at stake.

“Any time you can expand public understanding of the risk a homeowner faces, it’s a good thing,” Barry said.

Water damage is the second-leading cause of insurance claims in Illinois, according to 2009 data from State Farm Insurance Cos. After wind and hail, water wreckage comprised the largest number of claims, averaging $7,900. Crime was third, and a different kind of water devastation — drain and sewer backups — was fourth, averaging $8,800 per claims.

Decatur, Ill.-based Peerless thinks its novel “flood house” laboratory will add depth to classes like “Hands-on Water Damage,” which they offered in December to nine insurance agents and assistants needing continuing education credits. Company officials said they know of a handful of such houses around the country and had seen a couple, but not outfitted like theirs.

When the company moved its Springfield location last summer, it bought and remodeled the house across the alley for about $90,000, adding carpeting, a restored hardwood floor and fresh paint — all ready to be drenched.

Learning what goes into drying soaked carpets, drywall with insulation behind it, and ceilings buffeted by leaking upstairs toilets — and then seeing it happen — pays dividends when that panicked call comes in from a client, said Matt Bennett, an agent from Forsyth, Ill., who attended the demonstration.

“You know what questions to ask,” Bennett said. “When the homeowner says, ‘I have a small leak,’ you know that’s how it appears, but we can take what they tell us to find out if there are hidden sources of the problem.”

After a morning learning about degrees of contaminants in water and how many dehumidifiers are necessary per cubic foot, the group assembled on the first floor of the flood house, which was bright, clean and kitchen-less. Peerless vice president Todd Garner then cranked on the first sprinkler over a glass-top table and padded chairs, onto the hardwood floor.

It sounded like rain pounding on the table. Water shooting in all directions from the sprinkler heads gave a carousel effect as Garner maneuvered levers in the wall. Nearly everyone in the room wore a sheepish smile, perhaps feeling a little sick. That’s the point.

“You have a customer who’s gone for a weekend, and a half-inch line breaks, it’s going to be whipping out a lot of water,” Garner said earnestly.

The agents took turns with the garden hose, saturating the carpet, then later returned to test water extraction methods, from the hardware-store bought wet-dry vac to a Segway-like riding machine that professionals use. The high-end model sucked nearly all the water out of not only the carpet, but the pad underneath.

“When someone calls, if you’ve never lived through a disaster, you haven’t any idea what they’re experiencing,” said Hopp, who processed claims from a deadly Petersburg tornado last New Year’s Eve. “Now we see what they’re seeing.”

[footer1]

- Published in In the News

After one of the largest snowstorms in decades, the Northeast will now be without power for a third day. This snow storm has brought down trees and power lines, and knocking out electricity to customers in Connecticut, New York, and New Jersey. The damage is now widespread and could possibly take a week to regain energy. The storm spread wind, rain and snow from West Virginia to Maine. Wet, heavy snow fell on trees that hadn’t yet shed their leaves, causing branches to break and bring down power lines and damage roofs of homes.

After one of the largest snowstorms in decades, the Northeast will now be without power for a third day. This snow storm has brought down trees and power lines, and knocking out electricity to customers in Connecticut, New York, and New Jersey. The damage is now widespread and could possibly take a week to regain energy. The storm spread wind, rain and snow from West Virginia to Maine. Wet, heavy snow fell on trees that hadn’t yet shed their leaves, causing branches to break and bring down power lines and damage roofs of homes.

Many people, aside from having no power, have damage to their homes because of this terrible storm. As a policy holder it is important to know what is covered under your policy. Many people are unaware of things that you can claim from your insurance such as food loss or loss of use. It’s important to understand your policy and if it includes damage caused by snow, hail, ice and sleet. It may also cover the occasional plumbing problems, frozen pipes, and power outages. Contact a public adjuster to get claim help and understanding of how they can assist you to recover from your loss.

Below are some tips from NJ Office of Emergency Management pertaining to the hazards of power outages and what to do.

- Call your utility to determine area repair schedules.

- Listen to your battery-powered radio or television for updated information, and for any directions from public safety officials.

- Remember: A battery-powered radio is a key part of your Emergency Supply Kit.

- Use only a battery powered light, such as a flashlight, for emergency lighting! Due to the extreme risk of fire, DO NOT use candles during a power outage.

- Avoid elevators.

- Turn off or unplug lights and appliances to prevent a circuit overload when the power returns. Leave one light on to let you know when power has been restored.

- Protect yourself from carbon monoxide poisoning:

- Do not operate generators indoors.

- Do not use charcoal to cook indoors.

- Do not use your gas oven to heat your home.

- All of these activities can cause a deadly buildup of carbon monoxide gas. Use space heaters with proper ventilation.

- Keep your refrigerator and freezer doors closed as much as possible to avoid food spoilage.

- Be sure to check on neighbors, especially the ill, those with electric-dependent medical needs and the elderly.

- If it is cold outside:

- Turn on faucets slightly to prevent pipes from freezing. Running water will not freeze as quickly.

- Put on layers of warm clothing.

- NEVER use your oven as a source of heat!

- If power may be out for a prolonged duration, plan to go to another location that has heat to keep warm.

- During a heat wave:

- Watch for heat-related illnesses, especially in children who may not be able to verbalize how they feel.

- Drink plenty of water, even if you do not feel thirsty.

- Provide plenty of fresh, cool water for your pets.

AFTER A BLACKOUT: WATER TREATMENT

In addition to having a bad odor, and taste, water from questionable sources may be contaminated by a variety of microorganisms, including bacteria and parasites that cause diseases such as dysentery, cholera, typhoid, and hepatitis. All water of uncertain purity should be treated before use.

The American Red Cross recommends the following steps for treating water after a power outage or other emergency, if the water’s purity is uncertain:

- Filter the water using a piece of cloth or coffee filter to remove solid particles.

- Bring it to a rolling boil for about one full minute.

- Let it cool at least 30 minutes. Water must be cool or the chlorine treatment described below will be useless.

- Add 16 drops of liquid chlorine bleach per gallon of water, or 8 drops per 2-liter bottle of water. Stir to mix. Sodium hypochlorite of the concentration of 5.25% to 6% should be the only active ingredient in the bleach. There should not be any added soap or fragrances. A major bleach manufacturer has also added Sodium Hydroxide as an active ingredient, which they state does not pose a health risk for water treatment.

- Let stand 30 minutes.

- If it smells of chlorine, you can use it. If it does not smell of chlorine, add 16 more drops of chlorine bleach per gallon of water (or 8 drops per 2-liter bottle of water), let stand 30 minutes, and smell it again. If it smells of chlorine, you can use it. If it does not smell of chlorine, discard it and find another source of water.

FOOD SAFETY

Remember: Food that has not been refrigerated can cause severe health problems.

- Published in In the News

Hurricane Irene update: latest on N.J. power outages

Hurricane Irene update: latest on N.J. power outages

STATEWIDE — As of 9 a.m., PSE&G said there were 250,000 customers without power due to the heavy winds and driving rain caused by Hurricane Irene.

About 70,000 customers already had power restored, PSE&G said. The company, the state’s largest electric and gas utility, provides service to 2.2 million customers.

Around 170,000 JCP&L customers in New Jersey have lost power, according to spokesman Ron Morano, mostly in Monmouth, Ocean and Middlesex counties.

The Oyster Creek nuclear plant, which is on the Atlantic Coast south of Toms River, shut down on Saturday before Irene’s arrival, while PSEG’s nuclear plants near Lower Alloways Creek were still running Sunday morning.

“All three units remain at full power no issues at all,” said spokesman Joe Delmar at 8 a.m.

Delmar said wind speeds hadn’t come close to the site’s “unusual event” cutoff of 74 miles per hour that must be reported to the Nuclear Regulatory Commission.

“We’ll continue to monitor river levels as the storm settles down,” Delmar said. “It’s at low tide right now.”

As of 9:00 a.m. Sunday:

• A.C. ELECTRIC: 89,600

• PSE&G: 250,000

• JCP&L: 170,000

Storm conditions will likely delay repair efforts, said one PSE&G official early this morning.

“Crews will begin to restore service once the heavy winds subside and it is safe to work on overhead electric lines,” said Karen Johnson, spokeswoman for PSE&G. “Customers should be prepared for potentially lengthy outages.”

More power outages may be in store as forecasters predict maximum sustained winds between 40 to 50 mph with gusts up to 70 mph, according to the National Weather Service.

As rainfall from Hurricane Irene ramps up, southern Jersey is getting hit the hardest with widespread outages. In northern Jersey, PSE&G reported outages due to heavy winds that knocked trees and limbs onto power lines.

In Atlantic City, widespread outages were also reported and casinos closed for only the third time since gambling was legalized in the state in 1978 due to the storm.

[footer1]- Published in In the News

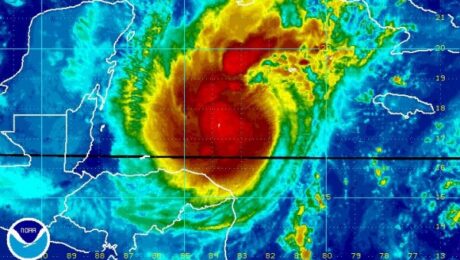

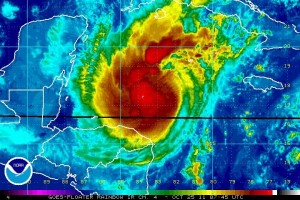

Rina, the 17th named storm and sixth hurricane of the 2011 Atlantic hurricane season, formed on October 23, 2011. Rina rapidly intensified from a tropical depression to a Category 1 hurricane with 75 miles per hour winds in 21 hours. The rapid intensification came due to the extremely warm waters over the western Caribbean. The forecast track and intensity of the storm is very complicated as the models are having a difficult time figuring out what Rina will do.

Rainbow infrared image of hurricane Rina on October 25, 2011. Image Credit: National Hurricane Center

For now, hurricane Rina is expected to gradually strengthen into a major hurricane and push into the Yucatan Peninsula by Thursday. After that, Rina will likely weaken and push to the east or northeast. Everyone from the Yucatan Peninsula, Cuba, and southern Florida should monitor Rina as the storm poses a threat to these regions.

As of 5 a.m. EDT today, hurricane Rina is a Category 2 hurricane with sustain winds of 100 mph. It has a pressure of 975 millibars (mb), and is currently pushing very slowly to the west-northwest at 3 mph. A tropical storm watch has been issued for the Yucatan Peninsula from Chetumal to Punta Gruesa. Meanwhile, a hurricane watch is in effect from north of Punta Gruesa to Cancun. Hurricane warnings will likely be activated later tonight into Wednesday morning as Rina approaches the Yucatan Peninsula.

Here is the forecast track for hurricane Irene from the National Hurricane Center (NHC):

Five day forecast track of hurricane Rina by the NHC.

Five day forecast track of hurricane Rina by the NHC.

Hurricane Rina is currently over the warmest waters in the Atlantic basin. The warm waters are not only at the surface, but extend deep into the ocean. When a storm is over a depth of very warm waters, upwelling cold water is typically never an issue. Instead of upwelling cooler water from the surface, the storm simply upwells warm water which can provide it more fuel to strengthen. Here’s a look at the warm waters in this area:

Heat content in the Atlantic ocean is the warmest in the Caribbean.

Heat content in the Atlantic ocean is the warmest in the Caribbean.

The intensity forecast is rather difficult. Rina is a small storm, so it is capable of developing rapidly in the next 24 hours. The larger the storm, the more time it takes for it wrap around itself, tighten up, and become a stronger storm. However, small storms are also vulnerable to wind shear and dry air which can invade the system rather quickly.

There are three things tropical systems hate: wind shear, dry air, and sea surface temperatures below 80 degrees Fahrenheit. With this in mind, let’s take a look at a few features:

Water Vapor imagery on October 25, 2011 showing dry air in the Gulf of Mexico. Image Credit: CIMSS

Water Vapor imagery on October 25, 2011 showing dry air in the Gulf of Mexico. Image Credit: CIMSS

The image above shows water vapor across the United States and the Atlantic basin. The darker the colors, the drier the air. The darker shades of gray and white indicate more moisture in the atmosphere. It is very evident that there is very dry air in the Gulf of Mexico. If Rina pushes into the Gulf, dry air could be a huge problem for Rina. Once Rina begins to drag dry air into the core of the system, weakening will be likely.

Wind shear analysis on October 25, 2011. Wind shear is fairly high in the Gulf of Mexico. Image Credit: CIMSS

Wind shear analysis on October 25, 2011. Wind shear is fairly high in the Gulf of Mexico. Image Credit: CIMSS

Not only is dry air significant in the Gulf of Mexico, but so is wind shear. Wind shear of around 30 to 50 knots can be found around the gulf, which does not bode well for tropical systems. If Rina wants to intensify, it must do so while it is in the western Caribbean. Once it approaches the Yucatan Peninsula and moves near Cuba, weakening will be very likely as wind shear increases.

The models are having a difficult time figuring out the exact track for hurricane Rina. For now, the models are showing the system pushing into Yucatan, weakening, and eventually moving due east and dissipating. Towards the end of the week, a decent trough, or extended area of low pressure, will push into the eastern United States. If the storm is relatively strong, Rina could “feel” the effects of the trough digging south. If this happens, Rina will likely be pulled to the northeast and merge into the frontal system. However, models show enough weakening that Rina does not feel the pull from the trough, thus staying in the Caribbean and dying out due to high wind shear and dry air intrusion.

Forecast track and especially intensity is still uncertain. Hurricane Rina is expected to become a powerful Category 3 hurricane with 115 mph winds in the next 36 to 48 hours. It is possible the storm could be stronger than that, especially if wind shear and dry air does not enter the system and it stays over the very warm waters in the western Caribbean. If a trough somehow picks up Rina, the storm could impact southern Florida as a weak hurricane or strong tropical storm by the end of the week. Regardless of the track, everyone along the Yucatan Peninsula, Cuba, and southern Florida should keep a close eye on Rina as the storm spins in the western Caribbean. You can get the latest updates on Rina by visiting the National Hurricane Center.

- Published in In the News

| ADDITIONAL COVERAGE BY ENDORSEMENT Our policies are designed to meet the needs of our average policyholder. We chose to exclude coverages most of you do not need. However, after reviewing the basic coverages automatically provided, you may feel your unique needs require more specific or additional protection. We may be able to provide that protection by endorsement. An endorsement is an attachment to your policy that amends the coverages already provided. The following are some of the more commonly purchased endorsements and the coverages they provide; others are available upon request. If made a part of your policy, each of these endorsements will result in an additional charge. Let us customize a policy for your specific needs. Policy deductible applies to each endorsement unless otherwise indicated. HO-32 Special Coverage Endorsement — (Condo Unit policies only) Without this endorsement, damage to the residence premises is covered only if it is caused by one of the perils listed in the policy. This endorsement provides broader coverage — responding to any cause except for those specifically excluded. For instance, this endorsement would cover accidental damage to floors, ceilings and walls such as spilling paint, or scorching a kitchen countertop with a hot pan. HO-35 Loss Assessment Coverage — If you belong to an association of property owners, and if the association is liable for someone else’s Bodily Injury or Property Damage, or if you must pay your share of covered damage to the group’s jointly owned property, the policy will cover up to $1,000 of your share of this cost. This endorsement permits you to buy coverage higher than $1,000 or coverage for more than one location. HO-48 Other Structures — If you feel that the limit for Coverage B Other Structures automatically provided by your policy (10% of your Coverage A Dwelling limit for one– and two-family residence in New Jersey and Pennsylvania; 5% of your Coverage A Dwelling limit for three– and four-families applicable to New Jersey policies only) is not sufficient, this endorsement can be used to increase your coverage. HO-53 Credit Card, Fund Transfer Card, Forgery and Counterfeit Money Coverage — All policies will pay up to $500 if your credit card or fund transfer card is used by an unauthorized person, or if you experience a loss as a result of a check forgery or the acceptance of counterfeit money. If you feel that $500 is not enough protection, this endorsement is used to increase your coverage. (Policy deductible does not apply.) HO-61 Scheduled Personal Property (available to New Jersey Manufacturers Insurance Company policyholders only) — This endorsement provides broader protection for specific articles of jewelry, fur and/or silverware by describing the covered items on your policy. An up-to-date appraisal which must be acceptable to our underwriters is required for each item before coverage can be afforded. For additional information, please request a Scheduled Personal Property application package. (No deductible applies.) HO-65 Coverage C Increased Special Limits of Liability — This endorsement can be used to increase the basic coverage for items 1, 2, 5, 6, 7,10 and/or 11 in the special limits Other lnsured Locations —If you own and occupy another one– or two-family residence, this endorsement can extend your Personal Liability and Medical Payments to Others coverages to that location. (Policy deductible does not apply.) This endorsement is also applicable for New Jersey policies for three– or four-family residences that you own and occupy. HO-70 Additional Residence Rented to Others Coverage — For an additional premium, you may extend your policy’s Personal Liability and Medical Payments to Others Coverages to any one– or two-family residence you own and rent to others. HO-75 Watercraft Endorsement — All policies automatically provide Personal Liability and Medical Payments Coverages for: (1) any watercraft equipped with inboard or inboard-outdrive motor power of 50 horsepower or less if rented to you, (2) a sailing vessel less than 26 feet in length if owned by or rented to you, and (3) any watercraft powered by one or more outboard motors with 25 or less total horsepower if the outboard motor(s) is (are) owned by you. If you own or rent a type of watercraft not included above, Personal Liability and Medical Payments may be obtained by purchasing this endorsement. Damage to your watercraft itself is not covered by this endorsement. (Policy deductible does not apply.) HO-76 Limited Escaped Fuel Liability Coverage — Applicable to policies first written in New Jersey on January 1, 2009 and later, and Pennsylvania policies first written on June 1, 2009 and later. Coverage for personal liability due to leaks from fuel systems such as oil tanks is excluded from your policy unless you purchase the HO-76 endorsement, which will provide $100,000 in liability protection. Your first policy year is your ONLY opportunity to purchase this endorsement. If you decide to purchase the HO-76, you will also have $10,000 of coverage, at no additional charge, for remediation and/or restoration expenses that are a direct result of covered liability claims for fuel leakage. Fuel tank replacement is not included, but expenses incurred for property restoration using like kind and quality soil, shrubs and other landscaping materials would be covered. You will not have this remediation coverage without purchasing the HO-76. The HO-76 endorsement will remain on your policy each year at renewal unless you request to remove it. Once coverage has been withdrawn it cannot be reapplied. If you are a Pennsylvania policyholder insured prior to June 1, 2009, liability for leaking fuel systems will continue to be covered without the need for any endorsement so long as your policy remains in effect. HO-95 Water Back-up and Sump Overflow Coverage — The standard policy does not provide coverage for damage caused by water back-up and for water overflowing from a sump. However, if you inform the NJM Insurance Group that your dwelling has a sump pump, this endorsement will provide up to $5,000 for this type of loss, even if it is caused by the mechanical breakdown of the sump pump. Coverage does not apply, however, to the sump pump or related equipment caused by mechanical breakdown. The maximum benefit limit is concurrent with your other coverage amounts; it does not increase the total limit of Coverage A (Dwelling) for HO-2, HO-3 and HO-6 or Building Additions and Alterations for HO-4, B (Other Structures), C (Personal Property) or D (Loss of Use) stated in your policy declarations. HO-95X Water Back-up Coverage — The standard policy does not provide coverage for any loss caused by water which backs up through sewers or drains. However, the HO-95X endorsement provides up to $5,000 for this type of loss. The maximum benefit limit is concurrent with your other coverage amounts; it does not increase the total limit of Coverage A (Dwelling) for HO-2, HO-3 and HO-6 or Building Additions and Alterations for HO-4, B (Other Structures), C (Personal Property) or D (Loss of Use) stated in your policy declarations. HO-277 Ordinance or Law Coverage — The ordinances or laws of your community may require the rebuilding of a damaged home to be in compliance with current building code standards rather than rebuild the structure as it was before being damaged. This coverage will pay for the additional expense of meeting current building codes up to your Ordinance or Law Coverage limit. Your policy will provide Ordinance or Law Coverage of up to 10% of your Coverage A (Dwelling) limit at no extra cost for homeowners (HO-2, HO-3) or condominium owners (HO-6) policies. The HO-277 endorsement will increase coverage in incremental amounts above 10% to a maximum of 100% of the Coverage A limit for a higher premium. For renters/tenants (HO-4) policies, the standard coverage for building code upgrades is 10% of the Building Additions and Alterations Coverage amount, and may be increased to 100% of this coverage limit for a higher premium. HO-290 Personal Property Replacement Cost Endorsement — All policies provide reimbursement for covered personal property losses (not the building itself) based on the actual cash value at the time of the loss but not exceeding the amount necessary to repair or replace the covered property. This means that after determining the amount to repair or replace the covered property at today’s costs, a deduction will be made for any depreciation. If this endorsement is attached to your policy, covered property losses will instead be settled at replacement cost value, meaning that we will settle any losses at the amount necessary to repair or replace the covered property at today’s costs. HO-315 Earthquake Coverage — While earthquakes are rare for this part of the United States, the possibility always exists. Earthquakes are not covered under a homeowners policy. Protection from this risk requires that a separate endorsement (HO-315) be added. Rates for this coverage are lower in our region as opposed to a high-risk area for earthquakes such as California. HO-452 – Residence Held in Trust (New Jersey policies only) HO-455 – Identity Fraud Expense Coverage (New Jersey policies only) HO-458 – Other Members of Your Household (New Jersey policies only) HO-459 – Assisted Living Care Coverage (New Jersey policies only) |

||

- Published in F A Q, In the News

AFTER the shrewd and wary real estate blogger known as Grim (real name: James A. Bednar of njrereport.com) bought his first house last spring, he quickly announced where he would start with renovations: the damp basement.

Showing and telling with pictures on his blog — which up to then had concerned itself only with the vagaries of the market and how to get a deal — Mr. Bednar demonstrated to his hundreds of followers the “right way” to keep a basement dry.

He excavated dirt to eight inches below the foundation, laid down stones and drainpipes, applied flashing and asphalt coating to the foundation walls, insulated them with foam board, and then regraded the property with backfill.

This was three months before Tropical Storm Irene; did we mention Grim is shrewd?

Mr. Bednar’s basement did stay dry — although Wayne, which has many low-lying areas that are federally designated flood plains, was among the hardest-hit communities in the state. President Obama even stopped by Wayne (along with neighboring Paterson) to view the devastation and promise aid in rebuilding.

In the view of some worried brokers and agents, though, rebuilding buyer confidence in a piece of real estate, once it has gotten wet, may be beyond anyone’s powers.

“Anytime there is penetration — even seepage, even if only under extreme circumstances,” said Robert Lindsay, an agent at Coldwell Banker who has been selling houses in Wayne for 35 years, “it will affect property value.”

In Mr. Lindsay’s view, damage to buyers’ confidence in certain neighborhoods, or in specific houses affected by Irene, might take years to repair. “This is the hottest hot button there is for buyers,” he said. “People do tend to have short memories, but in this case, they figure, if it happens once, it can happen again.”

Right now, of course, extreme circumstances prevail — and buyers are probably “gun-shy” anyway, as Gary Large, the president-elect of the NJ Association of Realtors, put it. Mr. Large is also the Morris County manager for Prudential New Jersey Real Estate in Morristown.

In many towns in northern New Jersey that have high water tables, homes are generally equipped with sump pumps, and often battery backups, since home inspectors usually recommend them when buyers request a report on a home before purchase.

But sump pumps are not necessarily enough of a confidence booster in today’s climate, said Susan Hunter, the vice president of the Lois Schneider Realtor in Summit. One agent with her company had a closing scheduled for Aug. 30, two days after the storm. During the walk-through inspection, Ms. Hunter said, “the seller mentioned that for the first time in 30 years,” because of Irene, “there had been some minor seepage into one area of the basement.”

The buyer’s lawyer immediately insisted that money be put in escrow to cover the cost of repairs if the situation worsened.

Post-storm jitters have also been contagious among lenders, Ms. Hunter said. “Many banks are now requiring a ‘final inspection’ by the appraiser to inspect the home for storm damage before closing,” she said in an e-mail.

“We have already had a couple of closings delayed by this process,” she added. “Unfortunately it can cause a domino effect: if one buyer can’t close, the buyer for his house can’t close, and so on and so on.”

State real estate regulations require sellers to disclose whether a basement has ever been wet or damp, and to complete a disclosure form at the time a house is listed.

If sellers have not told the truth, and the basement floods after closing, “there is a viable potential for damages against the seller,” said Ken Baris, the president of the Jordan Baris agency in West Orange (where there was also widespread basement water damage from the storm).

One of Mr. Baris’s agents, Mary Louie, helped her daughter Frances Louie last year with the purchase of a three-bedroom home in Springfield on a street that lies within a flood plain.

“We knew it was a flood plain, obviously,” the younger Ms. Louie said. “We had to get flood insurance. But there have been a lot of big storms this year, and we never had flooding.”

Lenders require buyers in areas categorized as flood plains to obtain the insurance, which is available through theFederalEmergency Management Agency. On the Web site, floodsmart.gov, anyone can search whether risk of flooding for a given address is “low to moderate” or “high.”

“The neighbors said there have been floods,” Ms. Louie said in Irene’s aftermath, “but nothing ever this bad. There is mud all over the walls in our basement.” At that point she was still awaiting the arrival of cleanup workers from the town’s emergency management office.

Several of her neighbors who have paid off their mortgages had let flood insurance lapse — and at one house water had risen almost to the second floor. “I guess they have lost everything,” she said.

Mr. Lindsay recalled clients in the late ’90s who had bought a house near a flood plain, but not in it, who were not required to get flood insurance. That changed in 1999 after Hurricane Floyd, which caused extensive flooding in New Jersey. Federal authorities redrew the map to widen the flood plain and include the property.

“It was a kick in the shins,” Mr. Lindsay said. “Now the owners have to accept both the stigma and the cost, around $25,000 a year.”

When floodwaters entirely recede this time around, Mr. Lindsay said, he predicts that FEMA will again redraw its maps.

No matter the precautions taken, however, the surprise factor is always there, and Mr. Bednar, for all his hard work, was not exempt. “The basement was bone dry, not a drop of water,” he reported. “The chimney, however, let us down. In our defense, we didn’t get there with the renovations yet.”

- Published in In the News

New Jersey’s northern suburbs remained in Hurricane Irene’s grip, with swollen rivers keeping more than 10,000 people from their homes and utility crews working to restore power to 190,000 customers.

New Jersey’s northern suburbs remained in Hurricane Irene’s grip, with swollen rivers keeping more than 10,000 people from their homes and utility crews working to restore power to 190,000 customers.

The state, the most densely populated in the U.S., was awaiting word on Governor Chris Christie’s request for a federal disaster declaration. Janet Napolitano, U.S. secretary of Homeland Security, today was scheduled to tour the hardest-hit areas, within 50 miles (80 kilometers) of New York City. President Barack Obama will visit Paterson on Sept. 4, the White House announced today.

“We expect the flooding to start to end today,” Mary J. Goepfert, a spokeswoman for the New Jersey Office of Emergency Management, said in a telephone interview. “Today is going to be challenging, and part of tomorrow. I would not say that everything is going to be all and well by Friday.”

From the beaches of North Carolina to New York’s Catskill Mountains and the ski resorts of Vermont, Irene blew through the Eastern Seaboard last weekend, killing 45 people, causing losses of about $12.4 billion and leaving 6.69 million homes and businesses without power.

The U.S. National Weather Service posted flood warnings for the New Jersey counties of Morris, Essex, Passaic and Morris through this evening. No rain was forecast for the area.

New Jersey Shelters

Obama today approved disaster applications from North Carolina, where the hurricane made landfall Aug. 27, and New York, where it hit the following morning as a weakened tropical storm. Vermont, which sustained its worst flooding in 75 years, was declared a disaster area yesterday. The designation triggers cleanup and restoration funding from the U.S. Federal Emergency Management Agency.

In New Jersey today, 852 people were in shelters in seven counties, Goepfert said. The evacuees were among 10,107 residents still barred from their homes after 11 inland rivers and their tributaries crested, some at record levels.

Teams were preparing to survey damage near the coast and head north as floodwater recedes, Goepfert said. Municipal workers in beachside towns were repairing boardwalks and restoring dunes in preparation for the long Labor Day holiday weekend, which marks the end of the tourism season.

Fairfield Submerged

In Fairfield, a township of 9,000 about 25 miles northwest of New York City, some areas were 8 feet to 10 feet (3 meters) beneath water that had flowed from the Passaic River, Deputy Police Chief Anthony Manna said. He spoke during a tour with a reporter aboard a 2 1/2-ton military truck, which was submerged to the bumpers. National Guard troops and police officers in boats took some residents from their homes.

Bill Fitzgerald, president of the Fairfield Volunteer Fire Department, said the water measured a mile wide in some places, and carried raw sewage, gasoline and chemicals. Responders dodged barbecue tanks, lawn furniture and lumber, he said.

“The biggest danger we have going on?” Fitzgerald said during an interview at the firehouse. “Pick one: natural gas leaks, electrical lines down, people staying in their homes and water.”

In New York, 19 of 62 counties will be eligible for aid, according to a release from Governor Andrew Cuomo’s office today, one day after the governor asked Obama for help.

New York Damage

The damage in New York state will be almost $1 billion, with 600 homes wiped out, six towns inundated, 150 major highways damaged and 22 state bridges closed, Cuomo said. He estimated $45 million in agricultural losses on 140,000 acres, a figure that is rising, he said at a press conference in Prattsville, a Catskills town ravaged by torrential rains.

Of the 328,907 customers without power statewide, more than half were on Long Island, Cuomo’s office said. The Long Island Power Authority estimates that 95 percent of its 190,000 customers will have their power restored by Sept. 2 at midnight. In the Catskills, about 17,000 customers don’t have power.

“These are not communities of deep pockets, and these are communities that will need economic help to restore themselves,” Cuomo said at the news conference.

In Vermont, Route 4, a gateway to ski resorts, was severed in a dozen places, state officials said. In and around Killington, 10,000 residents and vacationers were stranded, Town Manager Kathleen Ramsey said yesterday.

In North Carolina, seven counties will be eligible for federal disaster funding. The hurricane destroyed more than 1,100 homes and caused damage of at least $71 million, Governor Bev Perdue said yesterday.

Damage South

“We are estimating right this minute that we’re up to about $70 million worth of damage, simply in things that we’ve eyeballed,” Perdue said yesterday at a news conference. “We know there will be significant add-ons to that number with the debris and the business interests, and obviously you will layer on that agricultural and other kinds of issues. This has become an expensive hurricane for North Carolina.”

Irene caused losses of about $12.4 billion in the U.S., according to an estimate by Kinetic Analysis Corp., a firm that predicts the effects of disasters. Insurers and reinsurers will probably cover about $4.9 billion of that cost, according to Kinetic.

“This was not a very strong wind event, but it was a very strong water event,” Jan Vermeiren, chief executive officer of Kinetic, said in a telephone interview. Private insurers “rarely offer flood insurance, they only cover damage from wind.

- Published in In the News