Owning your own home or business comes with its challenges. When temperatures are warm, mother nature comes through and gives us hurricanes, and tornado’s. When temperatures are low, we begin to see hail storms and freezing temperatures. Throughout these changes, your home or business must be able to sustain these possibly destructive storms. If you currently still have a mortgage on your property, then you are required to retain property insurance, whether it is commercial or residential property. Even if you don’t have a mortgage on that  property, you should still maintain your insurance. As we have all seen the recent weather, there is no way you could know what to expect. It’s important to be prepared for whatever comes our way.

property, you should still maintain your insurance. As we have all seen the recent weather, there is no way you could know what to expect. It’s important to be prepared for whatever comes our way.

Within the last few months we have seen some extreme conditions. We have received tons of calls from policy holders that have suffered from hurricanes, tornado’s, flooding, water damage, pipe break/ pipe bursts, A/C and Dishwasher leaks, and roof damage. People tend to call after they have already filed a claim, and try getting money on their own. They don’t get what they wanted and then they call us, the public adjusters. Public Adjusters are licensed and bonded in being an advocates for a policyholder in appraising and negotiating an insurance claim.

If you suffer from property damage and have a residential or commercial claim, you should have someone that’s defending your claim from the beginning. Would you go into court and not have an attorney defending you? Probably not a good idea. Similar to attorneys, public adjusters only charge a percentage of your claim if and when we collect it for you. If we aren’t able to get you a settlement, then you don’t owe us anything!

Every year we pay thousands of dollars to our property insurance companies. If you suffer from hurricane damage, tornado damage, flood damage, water damage, pipe break/ pipe bursts, A/C and Dishwasher leaks, and roof damage, then your insurance will most likely cover it.

All American Public Adjusters, Inc. has over 20 years of experience in property damage and insurance claims. Whether you are in Florida, Georgia, New York, New Jersey, Minnesota, Wisconsin, Tennessee, Connecticut, and Philadelphia, we can help you with your property insurance claim.

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

- Published in Blog

35% percent of American households are comprised of renters, and 46 percent of those people have no renter’s insurance.

Do you know what it costs for you to be protected?

Here’s 1 example:

Allstate – Renters Insurance for a 4 bedroom town home near an ocean.

What’s covered: $15,000 in personal property protection

$100,000/per occurrence of Family Liability Protection

Up to 12 months of Additional living expenses

with a $500 deductible

And the cost? – $22.92 a month!

Renters appear to rely on their landlord’s homeowner’s insurance to protect them from damage or theft. Unfortunately, nothing that you own will be covered under their policy.

If you are ever to have a fire while making eggs or maybe your toilet overflows and floods your home, it’s worth it to be protected. Mother nature is very spontaneous as well. Keep your personal property protected.

- Published in Blog

Most states require that an insurance adjuster be licensed by the state in which the company operates. We receive numerous calls with policyholders unfamiliar with the difference between an independent insurance adjuster and a public insurance adjuster.

A person who holds a public insurance license works for policyholders only; they do not work for insurance companies, have no ties to insurance companies, and are not getting assignments from insurance companies. Public insurance adjusters assist policyholders with property insurance claims and are hired by the policyholders directly to present and handle the claim on their behalf.

Independent adjuster does not and cannot work on behalf of the policyholder. An independent adjuster has a different type of license that only allows him or her to work for an insurer not the insured. Some insurance companies have staff adjusters, and some contract independent adjusters to handle the claims.

Florida Statute § 626.855 defines independent adjuster:

An “independent adjuster” means a person licensed as an all-lines adjuster who is self-appointed or appointed and employed by an independent adjusting firm or other independent adjuster, and who undertakes on behalf of an insurer to ascertain and determine the amount of any claim, loss, or damage payable under an insurance contract or undertakes to effect settlement of such claim, loss, or damage.

In summary, a public adjuster exists to assist the homeowner and is contracted by the policy holder to adjust an insurance claim, and an independent adjuster is contracted by the insurer and works on behalf of the insurance company.

[footer1]

- Published in Blog

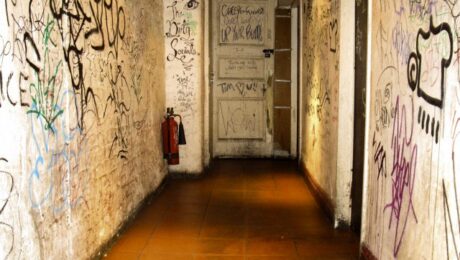

Understanding Theft Loss and Vandalism Claims in Missouri

While theft loss and vandalism claims are similar to filing any type of loss that occurs to a property, theft loss and vandalism claims require special attention to detail and expertise. When filing a vandalism claim, the following are some questions your insurance company will ask you:

- Did a theft/vandalism actually occur?

- Did the policyholder actually own or possess the items being claimed stolen, and if so, can proof be provided?

- What is the value of the item or items being claimed?

- Was there any related property damage such as broken windows, doors, locks, or equipment related to the theft or vandalism?

- Have you filed a police report?

- Do you have proper documentation to substantiate your claim?

In order for a vandalism claim to run smoothly, proper documentation is important. For example, if items are stolen from the property, you will need proper documentation to prove that the item was indeed in the property before the vandalism took place. This documentation could take the form of video, pictures, receipts, credit card statements, appraisals, insurance policy endorsements, etc. Try to provide as much documentation as possible to help prove the claim for theft with your insurance company.Its also a good idea to provide an itemized list of property items, so that there isn’t any discrepancy. Additionally, it will be essential that a police report be filed. This will prove to the insurance company that vandalism did occur at your residence.

[representyouinsurancepolicies]We recently have been helping homeowners and property managers handle vandalism claims in Kansas City, Missouri. For many vandals, copper wireing/plumbing and appliances are a hot commodity. We have helped property owners re-opened claims and renegotiation claims helping them get all the money the need to repair the property effectively. In addition we have helped homeowners and property owners from start to finish taking over the entire process so that everything is handled efficiently and effectively.

Although theft/vandalism claims are very common, they can be some of the most complicated and time consuming matters to resolve. Let a licensed professional from All American Public Adjusters guide you through the process.

[footer1]- Published in Blog

There is a lot of confusion when it comes to water damage and home insurance. In the state of Missouri, insurance claims are being denied and many Missouri homeowners are left with mold and water damage. With water damage being one of the most common claims filed, many homeowners have a lot of questions concerning why the insurance company didn’t cover the water damage loss.

What types of water damage does your insurance company cover?

Simply stated, as long as the property damage is not caused by homeowner neglect – not properly maintaining the property – the damage will be covered. The only exception to this rule is flood damage. If you are in a flood prone area, you will need to have a separate insurance or an addition for flood insurance.

Coverages

Pipe Break: Generally speaking, water damage from a burst pipe inside your hom will be covered by your standard homowners’ insurance policy.

In general, water damage from a burst pipe inside your home will be covered by a standard homeowners’ insurance policy. Additionally, if an outside pipe bursts and causes damage, that should be covered as well, however, you will be required to prove that the water damage was from the outside pipe burst. An insurance company may deny the claim if the insurance adjuster determines that the pipe burst was from a maintenance or improper drainage issue.

Keep in mind that most pipes burst because they freeze. Most insurance claims are denied for this very reason. If you left your home unheated during freezing weather, your insurance company could deny your claim on the basis of negligence. Some insurance companies will still pay for the water damage, but not the pipe itself; however, many insurance companies will deny the claim altogether. Prevention and proper maintenance are the key to ensuring that you home will not suffer loss and if it does, your insurance company will cover the loss.

Storm Damage: If water damage is the cause of a storm, your insurance company will cover the damage. It is important to have proper documentation for a proof of loss. The insurance adjuster will always assess the damage to see if in fact the damage was caused by the storm or if it was pre-existing.

After Filing a Claim, Get Experts Involved!

In a water damage claim, time is of the essence! As soon as water damage has occurred, you need to file a claim with your insurance agent. Once the file is claimed, if there is a lot of water involved, you will need to contact a water mitigation company to handle the removal of the water and to dry out the location effectively.

All American Public Adjusters are licensed professionals who can help you with your water damage claim from start to finish. We have a team of professions who have been helping homeowners handle their property claims with an excellent track record. Let us take over your claim so you can have an expert on your side to ensure that your investment is covered!

[footer1]

- Published in Blog

The Cold New Jersey Shore is still a Mournful Place after Hurricane Sandy Floods

[header1]

Although winter on the New Jersey Shore is usually bleak, after Hurricane Sandy, the residents of the New Jersey shore are experiencing a more than bleak winter this year – a winter than many will remember for years to come.

Many residents like Rayn Valli and his father Frank are still cleaning and trying to clean and trying to salvage belongings from their home in New Jersey after Superstorm Sandy. The family’s first floor was under 10 feet of water from Superstorm Sandy’s storm-surge, which destroyed several oceanfront blocks of Union Beach, leveling homes or lifting them off their foundations, breaking them apart and moving them. Devastating water damage to say the least is a common experience amongst New Jersey residents.

One hundred days later, the aftermath of Hurricane Sandy is now all about what comes next. Homeowners in New Jersey are uncertain what NJ will look like in the months or years that are ahead of them. Many are still waiting – some to move back home, others to hear from their insurance company on the next steps. Most are considering one of the biggest decisions they will have to make possibly in their lives: rebuild or walk away.

The Public Adjuster in New Jersey are helping homeowners find a peace of mind in the midst of turmoil. As homeowners look to get back on their feet, many in New Jersey are turning to insurance experts to handle their claim process. While some wait in uncertainty, those who have hired Public Adjusters in New Jersey can rest knowing that their investment is in professional hands.

[footer1]- Published in Blog, Public Adjuster

Even though it has been a few months since Hurricane Sandy hit the cost and flooded the streets of Staten Island causing much flood damage and loss, many homeowners continue to dig out their homes and face the reality of their ruined homes. As homeowners of Staten Island assess the flood damage from Hurricane Sandy, many will be facing the process of filing insurance claims as they try to recover from the devastation.

[header1]Navigating through the flood claims process can be overwhelming especially after experiencing a national disaster. Public Adjusters, experienced, licensed insurance professionals in Staten Island are working on behalf of homeowners to help through the process. Public Adjusters take over the claim process for the homeowner ensuring that the homeowner recovers what was lost during Hurricane Sandy. Additionally, many homeowners have found peace of mind in the midst of calamity as the Public Adjuster deals with the insurance and assists through the sandy insurance claim process.

As homeowners move forward to getting their lives back on track in Staten Island, many are looking to claims experts to handle their Staten Island flood damage claims to ensure that they recover their homes, belongings and most importantly, their lives.

[representyouinsurancepolicies] [footer1]- Published in Blog, In the News

Missouri Fire Insurance: How does it work?

The most devastating damage that occurs to homeowners a part from a natural disaster is fire damage. Due to the nature of fire property damage, in most occurrences, homeowners find their belongings destroyed and their home unlivable. Beyond the damage caused by the fire itself, both the smell of smoke and the soot residue are difficult if not impossible to mitigate.

No one expects this type of devastation to come to their front door, and it is important to know what to expect in the State of Missouri during a fire insurance claim as well as know the options that homeowners have when fire damage occurs.

Missouri Insurance and Fire Damage

All homeowner policies cover loss by fire and most common perils such as windstorm, hail, and vandalism. Most policies pay for three types of damage: 1) dwelling loss (damage to the house); 2) personal property loss (damage to your household contents); and 3) additional living expenses (the cost of living elsewhere while your home is being repaired).

The Process

If fire damage occurs, after contacting the fire department, contact your insurance agent immediately to initiate the . Make sure you take notes: Get the name of the person that you talk to, the claim number, and the adjuster’s name, and find out when the adjuster will contact you. If you get a recording, make a note of the day and time that you left a message.

Hire a Professional

A Public Adjuster, as stated by the Missouri Department of Insurance, is“a state-licensed individual who represents homeowners in claims negotiations with their insurance companies.” In other words, a Public Adjuster (PA) is an insurance claims expert who works on behalf of the homeowner to handle the claim process and ensure that the homeowner is reimbursed properly. Fire claims can be stressful and complicated. Public adjusters are trained to prepare dwelling damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy, although they cannot offer legal advice. Hiring a professional will not cost you any extra! In fact, when you hire a PA, you will receive more money that can be applied to your valuable investment, your home.They generally work on a contingent fee basis, that is, for a percentage of the amount recovered.

Why Hire All American Public Adjusters to Handle your Fire Claim?

At All American Public Adjusters, you are our client and your interests come first. Our expertise in managing claims will free you from the emotional and time consuming struggles with the insurance company. We know what to look for, how to talk the insurance language, and how to get results. Best of all you pay us nothing until your claim is completely settled. Our fees are on a percentage basis from the settlement, not out of your pocket.

We work hard to earn your trust, resolve your claim quickly, and to become a friend you can always count on.

While the most common and obvious damage that occurred during Hurricane Sandy is wind and flood damage, many home owners found their homes burned to the ground or damaged immensely by fire and soot after Sandy shook a neighborhood in Breezy Point. A devastating fire on the Rockaway Peninsula engulfed over 100 homes causing overwhelming fire damage and loss. Due to the fire damage and soot, many homeowners were unable to salvage their homes and or belongings.

Most homeowners are relying on their insurance companies to provide the funds to make their homes livable again. Because of the devastation many homeowners have been waiting for months on their insurance company and are losing hope and considering their home and investment lost.

During this time of devastation, many homeowners found the help of local Breezy

Point public adjusters to assist them in handling the claim process. Having a

professional claim consultant who understands the insurance claim process and

various coverages has helped homeowners regain hope in the midst of calamity.

Public adjusters are trained professionals who take the insurance claim process out

of the homeowner’s hands and help expedite the process ensuring homeowners

redeem what was lost.

When people in New York, New Jersey, and Pennsylvania hear about a hurricane, they don’t seem to think anything of it. They actually makes jokes and say that they have their movies and snacks and flashlights. The severity of a hurricane does not cross their minds because unlike people who live in Florida, Georgia, Texas, and other southern states that are used to hurricanes, they really don”t realize what this hurricane can do to them. Hurricanes, especially Hurricane Sandy, is a “megastorm.” The national weather channel predicts that the storm will make landfall by Tuesday. Sandy is supposed to make landfall in Ocean City, which is the most densely populated area containing 64 million people. Last year hurricane Irene caused only power outages to 6 million people in its path and this storm is definitely going to cause more. Many homes will not be able to withstand the impact of the strong winds and flooding. Most homeowners will not how to respond to type of extreme impact to their homes. You can always check on our site for the latest updates and news. Call All American Public Adjusters if your home is damaged from the winds and flooding. We are experienced in property damage claims and understand how difficult a time this may be for you. If you happen to be in the Atlantic City area, the flooding has already begun. Contact us if you have any questions. Our team of adjusters are licensed and bonded in Pennsylvania, New York, New Jersey. We are here to help 24-7. Contact us today at 800.501.1230.

When people in New York, New Jersey, and Pennsylvania hear about a hurricane, they don’t seem to think anything of it. They actually makes jokes and say that they have their movies and snacks and flashlights. The severity of a hurricane does not cross their minds because unlike people who live in Florida, Georgia, Texas, and other southern states that are used to hurricanes, they really don”t realize what this hurricane can do to them. Hurricanes, especially Hurricane Sandy, is a “megastorm.” The national weather channel predicts that the storm will make landfall by Tuesday. Sandy is supposed to make landfall in Ocean City, which is the most densely populated area containing 64 million people. Last year hurricane Irene caused only power outages to 6 million people in its path and this storm is definitely going to cause more. Many homes will not be able to withstand the impact of the strong winds and flooding. Most homeowners will not how to respond to type of extreme impact to their homes. You can always check on our site for the latest updates and news. Call All American Public Adjusters if your home is damaged from the winds and flooding. We are experienced in property damage claims and understand how difficult a time this may be for you. If you happen to be in the Atlantic City area, the flooding has already begun. Contact us if you have any questions. Our team of adjusters are licensed and bonded in Pennsylvania, New York, New Jersey. We are here to help 24-7. Contact us today at 800.501.1230.

- Published in Blog