All American Public Adjusters in Kansas City – Pipe Break Damage Claim Experts

Having a pipe break in the home can be one of the most frustrating experiences for a homeowner to have. If a pipe break occurs in your home, it is important to take the necessary steps in ensuring that you do can recover the damage that has occurred.

- Prevention is Key: Proper maintenance and insulation are essential. The reason why most pipes break is due to cold weather. Regularly check your pipes and make sure that they stay warm during the cold months.

- File a Claim Immediately: Contact your insurance agent or your insurance claims department as soon as you notice water leaking from a pipe break. They will set up a time when an adjuster can come and take a look at your property to assess the damage.

- Get Rid of the Wet Materials and Dry Out the Floors and Walls: In order to prevent any additional damage from occurring, you need to get rid of any wet materials, including carpet or flooring that is damaged. Calling a water mitigation company will assist you in making sure that the water is removed effectively and the property is dried out. NOTE: some insurance companies may deny some portions of the claim under NEGLECT if proper attention is not made in water mitigation.

- Document All Damaged Items: Make sure you take inventory of any and all items that suffered damage during the pipe break.

- Contact Your Plumber: Your insurance company is going to need a plumbers invoice in order for you to have your plumbing put back to how it was.

- Contact an Insurance Professional – Public Adjuster: Using a Public Adjuster, an insurance consultant who works for the homeowner and not the insurance company, will help you maximize your insurance claim. A Public Adjuster is an expert in insurance policy and claim handling. Water claims can be complicated, and hiring a public adjuster will help you get reimbursed fully for the property damage.

All American Public Adjusters are licensed professionals who can help you with your water damage claim from start to finish. We have a team of professions who have been helping homeowners handle their property claims with an excellent track record. Let us take over your claim so you can have an expert on your side to ensure that your investment is covered!

What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

Call for a Free Consultation today

[footer1]

- Published in Public Adjuster

Blizzard-like conditions are expected throughout the northeast from Washington to Boston. Heavy snowfall will spread from St. Louis, Louisville, Cincinnati, Pittsburgh, Charleston, New York, Philadelphia, Washington DC, Boston, Cape Cod, and Portland at approximately an inch a minute. While the snow is falling, winds will pick up to near freezing temperatures causing homes and businesses to experience an array of damages.

Blizzard-like conditions are expected throughout the northeast from Washington to Boston. Heavy snowfall will spread from St. Louis, Louisville, Cincinnati, Pittsburgh, Charleston, New York, Philadelphia, Washington DC, Boston, Cape Cod, and Portland at approximately an inch a minute. While the snow is falling, winds will pick up to near freezing temperatures causing homes and businesses to experience an array of damages.

Some things that policy holders should look out for:

-Power outages causing sump pump to fail or back-up causing flooding in homes and businesses

-Freezing pipes – Once thawed, will cause pipe breaks/bursts and flooding/water damage, structural damage, and mold

-Flooding – Once snow and ice start melting, the water begins flooding homes/businesses

-Ruined carpets and water damage to your ceilings and walls from leaks caused by ice dams or bursting pipes

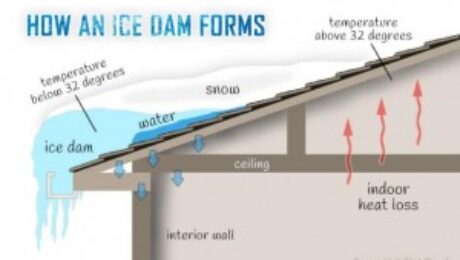

-Roof Damage – From ice dams that accumulate ice at the lower edge of a sloped roof, usually at the gutter, ice builds up and blocks water from draining off the roof causing water to be under the roof covering and into your attic or down the inside walls

Many of the above mentioned losses are covered by insurance companies. Filing a claim, although it sounds easy, is VERY tricky. The verbiage that is used when filing a claim can get you a denial immediately if not explained correctly. Most homeowners or business owners are not familiar with their policy and what is covered, let alone the details of their damage and the cost to repair or replace their lost items.

Public Adjusters are licensed and bonded by the state to help policy holders with their property damage claims. A public adjuster can review your policy, estimate your damage, and deal with the insurance company directly to conduct inspections and negotiate a fair settlement for your property damage claim. Whether you have already filed a claim or have a claim and don’t know what to do next, we can help. Contact All American Public Adjusters for your RISK FREE claims evaluation.

[middlerepresent][footer1]

- Published in Public Adjuster

Today’s day in age, people don’t really review their insurance policies. They purchase a policy based on what their insurance brokers gave them and think that they always have their best interests in mind. Many people also purchase a policy based on the lowest premium. As much as getting a good deal sounds great, its important to read between the lines.

Insurance policies consist of terminology that is often hard to understand. Nature is quite unpredictable. When a loss like a fire, flood, pipe break, wind damage from hurricanes, or tornado you need to know what to do and whom to call.

Public Adjusters assist homeowners and business owners with their property damage claims. Whether you have suffered from fire damage, flood damage, wind damage, hurricane damage, tornado damage, vandalism or theft, a public adjuster is the first call you want to make. A public adjuster can provide you with knowledge of insurance claims and what your policy covers. They will estimate your property damage and assist you with negotiating and settling your insurance claim as quickly as possible while making sure that you get the maximum settlement

Public Adjusters are licensed and bonded by the state. Before you start opening insurance claims and fighting a battle you have never faught, contact us today!

- Published in Public Adjuster

All American Public Adjusters in Kentucky- Water Damage Claim Experts

All American Public Adjusters in Kentucky- Water Damage Claim Experts

One of the most overwhelming losses that can occur to a home is water damage from freezing temperatures. When snow falls or temperatures freeze, homeowners and business owners begin to experience power outages causing pumps to fail and water to back up; Freezing pipes to break or burst and causing flood damage and water damage; Ruined carpets, ceiling, floors, and walls due to flooding; Roof Damage due to ice dams accumulating. If you have suffered from water damage, you are well aware that there is more damage that occurs than just the water in your home or business. Aside from the common interior issues (carpets, walls, floors), structural damage, mold damage, and the loss of indispensable belongings occur as well. As Public Adjusters, we have helped numerous homeowners handle their water damage insurance claims.

Whether it is water damage or major flood damage that destroys your entire home, let the experts at All American Public Adjusters handle your claim for you ensuring that you get full reimbursed. The public adjusters in Kentucky are trained to prepare dwelling water damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy concerning your water damage claim. We understand what is needed for you to be reimbursed for damage to your property and damage to your belongings if water damage has occurred.

We service the following areas in Kentucky: Lexington, Louisville, Bowling Green, Owensboro and the surrounding communities!

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster

This week is likely to provide little relief for residents in the Missouri area. Because of the recent freezing temperatures and ice storms, homeowners face many issues with their homes and businesses. Local residents in Jennings, St. Louis, Flourisant, St. Charles, and Kirkwood, Missouri have began filing claims with their insurance companies complaining of broken pipes and flooding to their homes. After record freezing temperatures occur, the snow begins to melt causing flooding to occur in many residential neighborhoods. Be sure to have someone on your side when fighting with your insurance company to cover your damages.

This week is likely to provide little relief for residents in the Missouri area. Because of the recent freezing temperatures and ice storms, homeowners face many issues with their homes and businesses. Local residents in Jennings, St. Louis, Flourisant, St. Charles, and Kirkwood, Missouri have began filing claims with their insurance companies complaining of broken pipes and flooding to their homes. After record freezing temperatures occur, the snow begins to melt causing flooding to occur in many residential neighborhoods. Be sure to have someone on your side when fighting with your insurance company to cover your damages.

What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster

Walking through the streets of Atlanta, Georgia after several storms have passed have been quite a devastating experience. This months storms including broken trees falling on homes, freezing temperatures, wind damage, pipe breaks, and flood damage, and power outages have made homeowners more aware of insurance claims. Although filing an insurance claim might sound quite simple, you don’t want to say the wrong terminology and have your claim denied. Insurance companies have their own adjusters that defend their perspective of the claim, you need to have your own adjuster to defend your most prized possession. Licensed Public Adjusters are there to assist policy holders with their property damage claim. We can assess your property damage, help you file your claim, and justify your damage with our own scope/estimate so that your pipe break, or wind damage, or flood claim, or power outage get covered and that you get a maximum settlement. If you have suffered from property damage from the recent storms that have hit Atlanta, Georgia and the surrounding area, then you need to contact a Public Adjusters today. Don’t let the insurance company deny your claim on a technicality. Call today for assistance.

- Published in Public Adjuster

All American Public Adjusters in Kentucky- Fire Claim Experts

All American Public Adjusters in Kentucky- Fire Claim Experts

One of the most devastating losses that can occur to a home is fire damage. If you have suffered from fire damage, you are well aware that there is more damage that occurs than just the fire. Smoke, Soot, and the loss of indispensable belongings. As Public Adjusters, we have helped numerous homeowners handle their fire insurance claims. Whether it is minor kitchen fire damage or a major home fire damage that destroys your entire home, let the experts at All American Public Adjusters handle your claim for you ensuring that you get full reimbursed. The public adjusters in Kentucky are trained to prepare dwelling fire damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy concerning your fire claim. We understand what is needed for you to be reimbursed for damage to your property and damage to your belongings if fire damage has occurred.

We service the following areas in Kentucky: Lexington, Louisville, Bowling Green, Owensboro and the surrounding communities!

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster

All American Public Adjusters in Iowa- Water Damage Claim Experts

All American Public Adjusters in Iowa- Water Damage Claim Experts

One of the most overwhelming losses that can occur to a home is water damage from freezing temperatures. When snow falls or temperatures freeze, homeowners and business owners begin to experience power outages causing pumps to fail and water to back up; Freezing pipes to break or burst and causing flood damage and water damage; Ruined carpets, ceiling, floors, and walls due to flooding; Roof Damage due to ice dams accumulating. If you have suffered from water damage, you are well aware that there is more damage that occurs than just the water in your home or business. Aside from the common interior issues (carpets, walls, floors), structural damage, mold damage, and the loss of indispensable belongings occur as well. As Public Adjusters, we have helped numerous homeowners handle their water damage insurance claims.

Whether it is water damage or major flood damage that destroys your entire home, let the experts at All American Public Adjusters handle your claim for you ensuring that you get full reimbursed. The public adjusters in Iowa are trained to prepare dwelling water damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy concerning your water damage claim. We understand what is needed for you to be reimbursed for damage to your property and damage to your belongings if water damage has occurred.

We service the following areas in Iowa: Des Moines, Fort Dodge, Waterloo, Cedar Rapids, Davenport and the surrounding communities!

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster

All American Public Adjusters in South Dakota- Fire Claim Experts

One of the most devastating losses that can occur to a home is fire damage. If you have suffered from fire damage, you are well aware that there is more damage that occurs than just the fire. Smoke, Soot, and the loss of indispensable belongings. As Public Adjusters, we have helped numerous homeowners handle their fire insurance claims. Whether it is minor kitchen fire damage or a major home fire damage that destroys your entire home let the experts at All American Public Adjusters handle your claim for you ensuring that you get full reimbursed. The public adjusters in Iowa are trained to prepare dwelling fire damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy concerning your fire claim. We understand what is needed for you to be reimbursed for damage to your property and damage to your belongings if fire damage has occurred.

We service the following areas in South Dakota: Aberdeen, Watertown, Rapid City, Sioux Falls and the surrounding communities!

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster

All American Public Adjusters in Iowa- Fire Claim Experts

All American Public Adjusters in Iowa- Fire Claim Experts

One of the most devastating losses that can occur to a home is fire damage. If you have suffered from fire damage, you are well aware that there is more damage that occurs than just the fire. Smoke, Soot, and the loss of indispensable belongings. As Public Adjusters, we have helped numerous homeowners handle their fire insurance claims. Whether it is minor kitchen fire damage or a major home fire damage that destroys your entire home, let the experts at All American Public Adjusters handle your claim for you ensuring that you get full reimbursed. The public adjusters in Iowa are trained to prepare dwelling fire damage repair estimates and to value damaged personal property. They are generally knowledgeable about the coverages provided by a typical insurance policy concerning your fire claim. We understand what is needed for you to be reimbursed for damage to your property and damage to your belongings if fire damage has occurred.

We service the following areas in Iowa: Des Moines, Fort Dodge, Waterloo, Cedar Rapids, Davenport and the surrounding communities!

[middlerepresent]What we do for you:

- Document Property and Contents Damage

- Maximize your insurance claim and minimize your stress

- Negotiate the insurance claim for necessary repairs or replacement for the loss

- Provide detailed estimates for the loss

- Reopen denials and ensure proper reimbursement

- Residential and Commercial Claims

[footer1]

Call for a Free Consultation today

- Published in Public Adjuster