COLORADO SPRINGS — Charred and contorted metal strips formed a stark barrier around piles of blackened rubble that used to be a two-story ranch style home at 5533 Majestic Drive.

COLORADO SPRINGS — Charred and contorted metal strips formed a stark barrier around piles of blackened rubble that used to be a two-story ranch style home at 5533 Majestic Drive.

“These were our beige gutters,” said Michael Fender, nudging the metal with his right foot. “I just don’t know … I don’t know what it is anymore.”

Fender and his wife lived in the three-bedroom home for 13 years, and on Thursday afternoon began preliminary inspections for what can be a painful and lengthy claims process in the wake of the Waldo Canyon fire. Aerial photographs show their street and a planned neighborhood known as Parkside lost at least 139 of their 178 homes in the blaze.

“It’s a rough situation,” said Mark Nix, an insurance property adjuster with Allstate who worked with couple. “In this first meeting, I just needed to measure the foundation and driveway and take some pictures.”

Since arriving in Colorado Springs earlier this week, Nix said he’s inspected about a dozen properties destroyed by the fire.

Following the initial site visit, the adjuster will then meet with residents a few days later to go over their personal property lost in the disaster.

“There’s a number of stages that it takes,” Nix said. “Eventually we hope to write them an estimate to get them rebuilt.”

Nix, based in Texas, travels all over the country — he has seen the damage wrought by floods, tornadoes and hurricanes.

“They’re all bad,” he said. “It’s heartbreaking.”

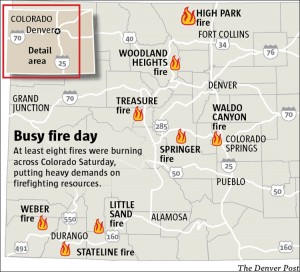

Colorado’s two largest property insurers reported Thursday that they received 1,449 claims for wildfire losses or expenses. The claims include total structural losses as well as damage from smoke and fire and requests for temporary living expenses from property owners displaced by fires.

Officials with State Farm said it had received 150 claims from northern Colorado’s High Park fire and 390 claims for the Waldo Canyon fire. Farmers Insurance representatives said the company has received 909 claims from all Colorado wildfires, with the majority from High Park and Waldo Canyon.

Both companies expect the numbers to grow as more fire damage is discovered and reported.

With a heavy thunderstorm forecast for this weekend, monsoon season likely to arrive in late summer and hillsides stripped of vegetation by the flames, residents in the area face another danger: Mud.

“Many homeowners do not realize the standard homeowners insurance policy typically excludes mudflow type losses,” Christopher Hackett, a director for the Property Casualty Insurers of America, said in a statement.

Across Majestic Drive from Fender’s home, Eugene and Cheryl Keckritz stood in their concrete driveway fixated on the foundation where their 2,200-square-foot home of 18 years once stood.

“It was Navajo white, with Zeus green trim,” said Cheryl. “We lost a lot. My dad’s old tool box … he died four years ago, and that’s what I kept as a memory of him. Now it’s gone.”

The Keckritzes said they’re fully insured and estimated their home was worth $240,000.

“I want to rebuild. We hope to rebuild, but right now it’s just too early,” Cheryl said.