New Jersey homeowners and business owners should expect to feel the effect of Tropical Storm Irene for years to come, insurance industry representatives and analysts say.

Private insurers are in the midst of shelling out roughly $915 million to cover damage from the storm in the state alone, according to the latest estimates by ISO, a Jersey City-based insurance risk advisory group. These insured losses, along with roughly $150 million to cover October’s freak snowstorm and $21.8 million for a string of severe weather last March, will be factored into the rate reviews that insurance companies make over the coming years, industry analysts say.

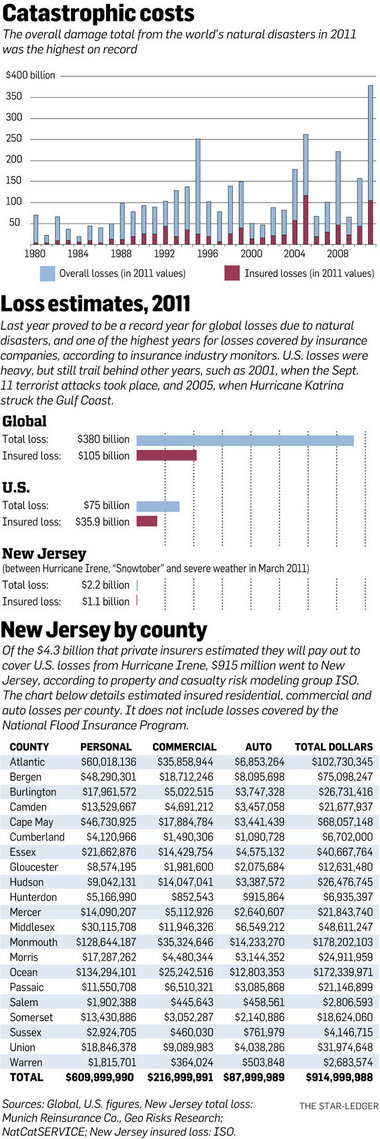

All told, the three events sapped nearly $1.1 billion from private insurers, making 2011 the costliest for New Jersey underwriters in ISO’s records. By comparison, New Jersey’s insured losses in 2010, which saw a devastating March nor’easter, were $486.7 million, said ISO, a leading provider of data on property and casualty insurance risk.

Though no single event sets the price of insurance, the rising toll of covering catastrophes in the state, across the nation and around the world will be reflected in rising premiums to come, industry watchers say.

“When companies experience high catastrophe losses in a certain region, they have to raise prices to recover their margins,” said Jimmy Bhullar, an insurance analyst at JPMorgan Chase.

Robert Hartwig, president and economist of the Insurance Information Institute, estimates that catastrophes will push the most common homeowner premium this year past the thousand-dollar mark.

U.S. homeowners on average paid $880 for the most common policy in 2009, according to data released this month by the National Association of Insurance Commissioners. Hartwig notes that prices have continued to rise for subsequent years and projects that nationally, the most common policy in 2012 will cost on average $1,004. Historically, New Jersey’s homeowner premiums have trailed U.S. averages.

Spokespeople for the state’s top home insurers said it’s too early to tell how last year’s storms will impact rates in New Jersey, and the state Department of Banking and Insurance, which approves rate changes in the state, is not anticipating increased requests to raise premiums due to last year’s storms, a spokesman for the regulator said.

But insurance executives have that warned higher rates are coming. Two-thirds of the executives who responded to a recent Insurance Information Institute survey said they expect premium growth in 2012, which can mean a combination of attracting new policyholders and raising rates on existing ones.

Tom Wilson, chairman and CEO of Allstate, told attendees at a Goldman Sachs-sponsored conference in December that large catastrophe losses of recent years have weighed on company profit. One way it is responding is to raise prices “dramatically,” Wilson said: 9 percent in 2009, 8 percent in 2010 and 6 percent through the first nine months of 2011.

“Raising price obviously brings in more money, which covers those increased costs,” he said.

Dino Robusto, president of personal lines and claims at Chubb, the Warren-based insurer, said on a call with analysts in October that the company has received approval to increase homeowner rates by 3 percent to 4 percent in key states “and we anticipate filing for additional rate increases as needed.”

Shared Pain

The world has seen an explosion of natural disasters in recent years, but the catastrophes that struck last year made 2011 the costliest on record both globally and in New Jersey. The tsunami-sparked meltdown of the Fukushima nuclear plant in Japan, flooding in Thailand and earthquakes in New Zealand were among 820 events around the world that caused, collectively, about $380 billion in damage, of which $105 billion was borne by insurance companies, according to Munich RE, one of the world’s largest providers of insurance to insurance companies.

href=”https://www.getclaimhelp.com/?attachment_id=597″ rel=”attachment wp-att-597″>

Overall damages in the United States last year paled in comparison to 2005, when Hurricanes Katrina and Rita punished the Gulf Coast and contributed to nearly $200 billion in total losses. But Irene, the deadly tornado in Joplin, Mo., and a record drought in Texas pushed the U.S. tally to about $75 billion of the world’s total losses, said Munich RE, whose U.S. headquarters are in Princeton. Of that, $35.9 billion was privately insured.

Irene alone is estimated to have cost the United States about $10 billion, of which $4.3 billion was covered by private insurers, Munich RE and the Insurance Information Institute have found.

The insured losses from Irene do not include claims covered by the federal National Flood Insurance Program. About $703.5 million has been approved for claims rising out of Irene, according to the Federal Emergency Management Agency, which administers the flood insurance program. Of that, $249.4 million went to New Jersey claims, FEMA said.

Private insurers that underwrite policies in New Jersey took the brunt of the storm, estimates from ISO show. They absorbed about 21 percent of the insured losses from Irene, which struck 13 states and Washington, D.C. The carriers are paying more than three times what the federal government has paid for flood insurance claims so far. Every county in the state reported seven-figure losses to private insurers, from $2.7 million in Warren County to $178.2 million in Monmouth County, said ISO.

Catastrophe Hit

The losses have eaten away at balance sheets. Last year, the property and casualty insurers paid $1.08 for every $1 they received in premiums, according to data from the Insurance Information Institute. That is the highest such ratio since 2001, and it is due to high catastrophe losses, dwindling reserves and the toll of the soft market, the institute said.

During the first nine months of 2011, private U.S. property and casualty insurers saw their net income dive to $8 billion from $27.1 billion during the same period in 2010, a 70 percent plunge, according to a joint study by ISO and the Property Casualty Insurers Association of America. Most of that was due to losses from major catastrophes, the groups wrote in a Dec. 27 release.

Chubb was among those hard-hit by Irene. Its third-quarter profit, reported in October, dropped 48 percent owing largely to catastrophe losses. Chubb in 2010 was New Jersey’s fourth-largest home insurer by market share, according to DOBI.

An Alternate Model

As punishing as 2011 was to insurers, individual catastrophes on their own do not drive up the cost of property insurance, companies and industry representatives say. Rather, companies use catastrophe risk models that assess disasters over many years and alongside other factors such as construction costs and commodity prices, which impact, for example, the cost of replacing asphalt, aluminum siding or copper pipes.

Some companies do not factor in actual claim experience from massive storms but use historic averages instead in order to smooth out spikes, said Deana Lykins, president of the Insurance Council of New Jersey. “This has the effect of dampening the impact of any individual event on the rate-setting process,” she said.

Yet insurance companies are reassessing their use of catastrophe-risk models, and the models themselves are changing after they failed to predict the toll of recent disasters, said Bhullar of JPMorgan.

Hartwig of the Insurance Information Institute said he expects the enormous impact of natural disasters last year, both in the United States and abroad, to drive rate increases in the years to come, even though the industry as a whole remains very well-capitalized.

He did not have a projection for New Jersey homeowner rates but said dwellers in coastal and high-value areas, as well as those hit hard by Irene, should expect to see their rates hiked. New Jersey homeowners have paid less than the national average, or $848 for the most common premium in 2009, according to the most recent NAIC data.

Rates in Check

Chris Hackett, director of personal lines policy for the Property Casualty Insurers Association, agreed that consumers in disaster-swept areas should expect to see a rise in rates. “It does come down to claims data in specific geographic areas,” he said.

But a number of global factors will keep rates in New Jersey from rising too high, insurance regulators say.

Most of New Jersey’s carriers were not directly exposed to catastrophic losses from around the world, said Marshall McKnight, a spokesman for the state’s banking and insurance regulator. Meanwhile the cost of reinsurance, the coverage that insurers buy to protect themselves and a factor in pricing premiums, has remained low, he said.

Mike Chaney, Mississippi’s insurance commissioner and chairman of NAIC’s property and casualty insurance committee, said the despite the “wishful thinking” of insurance company CEOs for higher premiums, other factors in the global economy will conspire to keep rates from rising too high. For example, low interest rates have made the reinsurance market an attractive place to park capital, which in turn will keep rates low, he said.

State regulators also have the ability to deny rate increases submitted for their approval if they are not adequately justified.

State Farm — New Jersey’s largest home insurer by market share, according to DOBI — last year in New Jersey handled 21,000 homeowners’ claims and another thousand automobile claims tied to catastrophe, said spokeswoman Arlene Lester. Yet the insurer, which has received rate increases averaging more than 6 percent nationwide over the last three years, is “not anticipating at this moment” a rate increase in light of claims being paid out, she said.

Allstate, the state’s second largest home insurer by market share, had a 5.9 percent increase in its homeowner rates in December, but the rate was filed before Irene and did not reflect losses from the storm, said spokesman Daniel Jovic.

A spokesman for New Jersey Manufacturers Insurance Co., the state’s third-largest home insurer by market share, said it is too early to tell what effect the disasters of the past year will have on rates. But the cost already has been tremendous. The mutually held company expects to pay out $76 million to cover home and auto claims from Irene, the costliest event in its near-century history, said spokesman Patrick Breslin. Its second- and third-most costly events were the March 2010 nor’easter, which cost $25 million, and October’s snowstorm, which tapped an estimated $13 million, he added.

But as large as Irene was, NJM did not have to call upon its reinsurance to help it cover claims, Breslin said. “We have prepared for catastrophes like this.”