In heated legislative battles, it’s common for one industry to be painted as the “villain.” I find it curious that in current debates regarding insurance issues, the villain role is somehow being projected upon those who advocate for you, the people of Florida.

Public insura nce adjusters have played an important role in the Florida insurance industry for more than 60 years. We are licensed and appointed by the state exclusively to represent insured policyholders, helping them navigate the complex insurance claims process in order to receive full and fair compensation from their insurer.

nce adjusters have played an important role in the Florida insurance industry for more than 60 years. We are licensed and appointed by the state exclusively to represent insured policyholders, helping them navigate the complex insurance claims process in order to receive full and fair compensation from their insurer.

When a homeowner’s roof is damaged, we help them secure the claim settlement they need to make repairs. When a water pipe bursts, we help them review their policies to ensure no coverages are missed and that full payment is provided. When a home is destroyed by fire, we help them document the loss according to their policy, to ensure they are fairly compensated.

Apparently, this makes us the bad guys.

We’re being blamed for driving up sinkhole insurance costs, though data provided to the state by insurance companies don’t support this allegation. The vast majority of public adjusters don’t handle sinkhole claims, and about 75 percent of claims are settled without representation by a public adjuster or attorney.

We’re being accused of filing fraudulent sinkhole claims, though the number of claims forwarded by insurers for investigation has fallen to 0.12 percent while the number of claims denied by insurers has more than doubled to 85 percent. Recent news reports have shown that most claims come from areas with previously identified sinkhole activity, that insurers have fought to delay a state database meant to track such activity, and that a state review of sinkhole claims does not factor in the impact of population growth in sinkhole-prone areas.

It has been said that our numbers have grown exponentially in Florida, when according to Department of Financial Service statistics, the opposite is true.

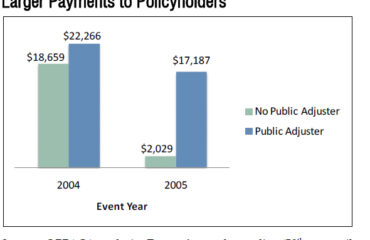

We’ve been told we should no longer be allowed to adjust Citizens Property Insurance claims, just one year after a legislative report showed we have a substantial positive impact on Citizens’ customers.

We’re accused of being “cost drivers,” keeping insurance companies from making a profit, while these same insurance companies are moving huge profits to less-regulated re-insurers that they own and manage.

We follow strict requirements and receive continuing education to maintain our licenses, while non-licensed individuals openly (and illegally) adjust claims.

Our job is to make sure people with valid insurance claims are treated fairly and receive the compensation they are due under the policies for which they’ve paid. We are licensed, bonded and trained to serve as the voice for policyholders. We are the only licensed insurance professionals who advocate for the insured.

If that describes a villain, would someone please tell me, who is the hero?

–

David Beasley is president of the Florida Association of Public Insurance Adjusters, based in Maitland, Fla.