Experience d Public Adjusters in Spartanburg, SC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Spartanburg, SC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

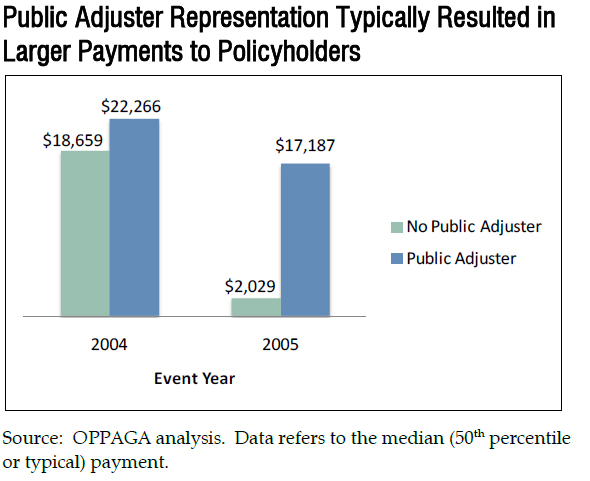

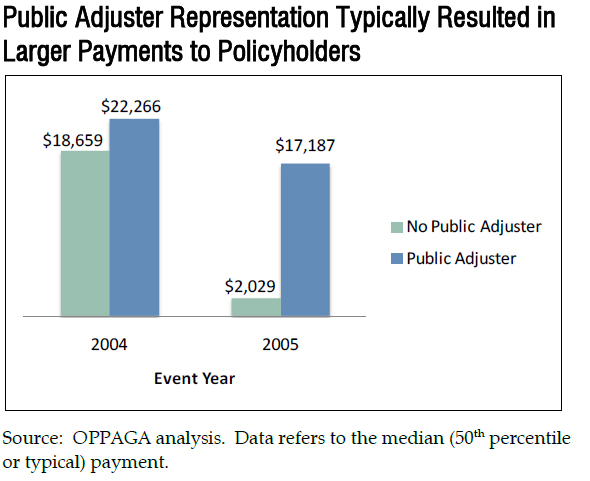

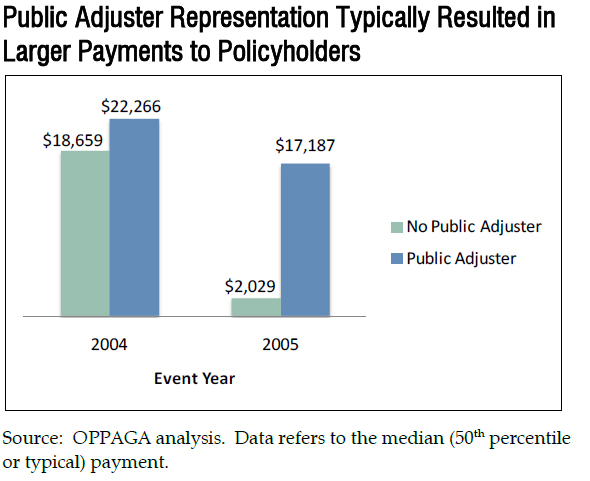

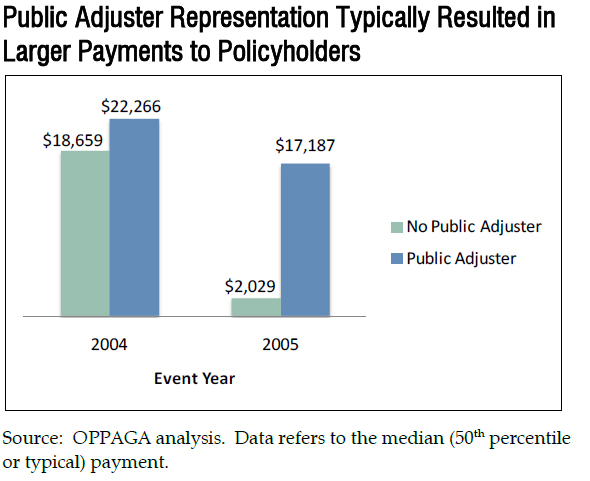

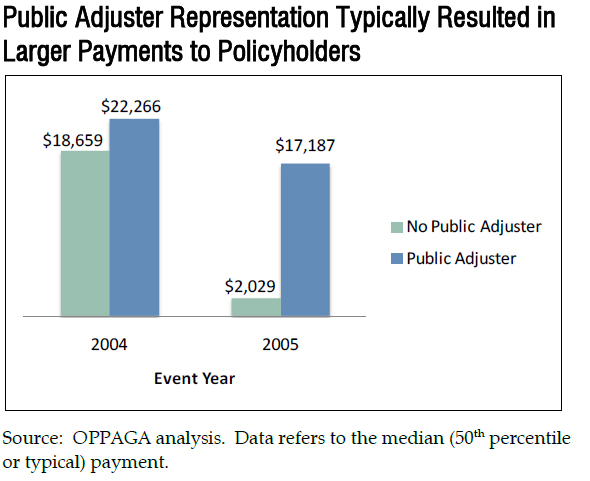

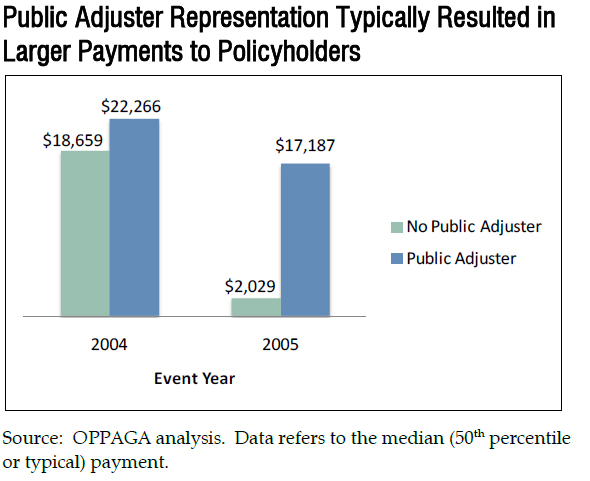

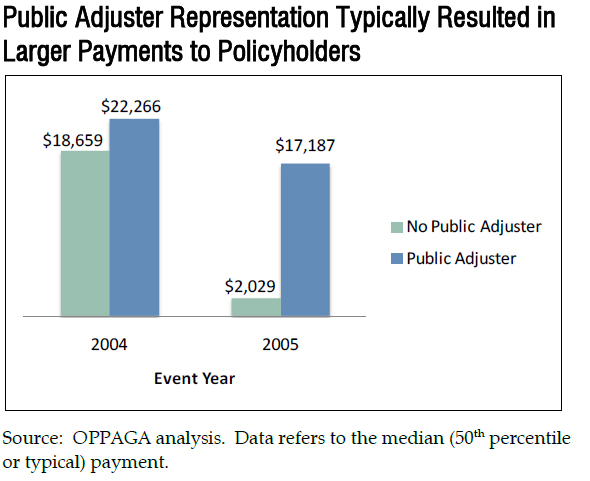

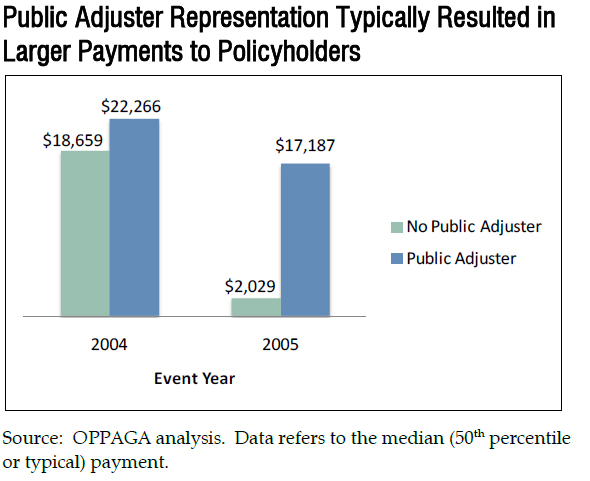

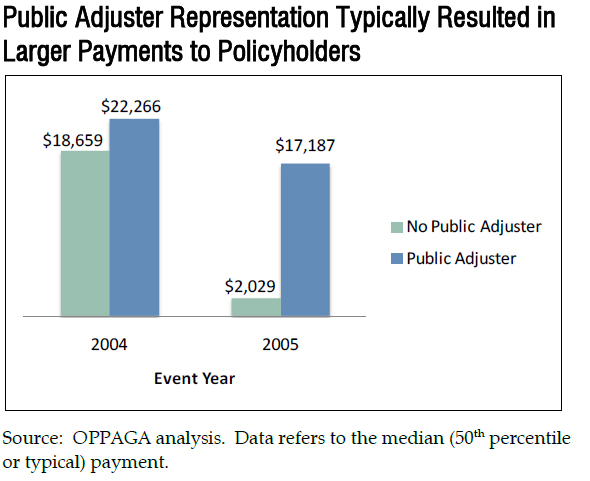

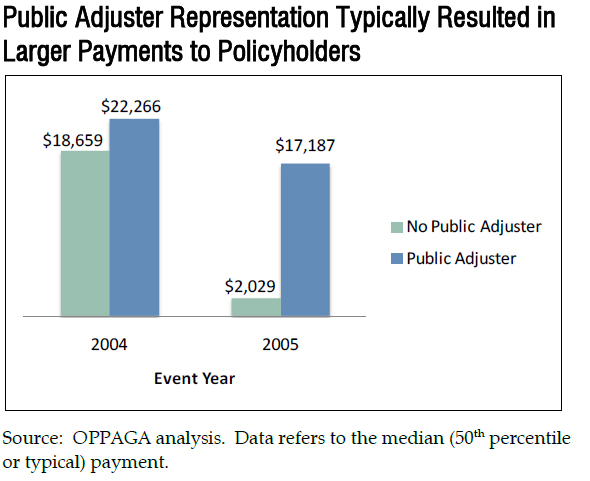

Why Use Public Adjuster in Spartanburg: Studies show using a public adjuster in Spartanburg, SC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Spartanburg works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Spartanburg County, SC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Spartanburg, SC services surrounding cities: Greer,Gaffney, Taylors, Wade Hampton, Simpsonville, Union, Mauldin, Greenville, Gantt, Berea, Parker, Laurens, Shelby, Clinton and Easley.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Summerville, SCour goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Summerville, SCour goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Summerville: Studies show using a public adjuster in Summerville, SC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Summerville works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Berkeley County, SC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Summerville, SC services surrounding cities:Ladson, goose Creek, HanahanNorth ,Charleston, Charleston, Mount Pleasant, Orangeburg, Georgetown, Sumter, Hilton Head Island, Savannah, Cayce and Columbia.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Greenville, SC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Greenville, SC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Greenville:Studies show using a public adjuster in Greenville, SC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Greenville works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Greenville County, SC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Greenville, SC services surrounding cities: Parker, Gantt, Berea, Wade Hampton, Maulding, Taylors, Greer, Simpsonville, Easley, Spartanburg, Clemson, Anderson, Laurens and Clinton.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Lakeville, MN our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Lakeville, MN our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Lakeville:Studies show using a public adjuster in Lakeville, MN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Lakeville works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Dakota County, MN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Lakeville, MN services surrounding cities: Farmington,

Apple Valley, Burnsville, Rosemount, Prior Lake, Savage, Eagan, Bloomington, Northfield, Richfield, Inver Grove Heights, Mendota Heights and Edina.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Hickory, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Hickory, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Hickory:Studies show using a public adjuster in Hickory, NC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Hickory works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Catawba County, NC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Hickory, NC services surrounding cities: Newton, Lenoir, Lincolnton, Morganton, Statesville, Mooresville, Cornelius, Gastonia, Kings Mountain, Mount Holly, Huntersville, Boone, Kannapolis and Charlotte.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 958- 6720

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Huntersville, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Huntersville, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Huntersville:Studies show using a public adjuster in Huntersville, NC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Huntersville works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Mecklenburg County County, NC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Huntersville, NC services surrounding cities: Cornelius, Mooresville, Mount Holly, Charlotte,Kannapolis, Concord, Mint Hill, Mattews, Gastonia, Lincolnton, indian Trail, Statesville, Salisbury, Newton and Kings Mountain.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Euclid, OH our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Euclid, OH our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Euclid:Studies show using a public adjuster in Euclid, OH has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Euclid works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Cuyahoga County, OH we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Euclid, OH services surrounding cities: Richmond Heights, Wickliffe, Willowick, South Euclid, Cleveland Heights, Lyndhurst, Eastlake, Mayfield Heights, University Heights, Shaker Heights, Beachwood, Cleveland and Mentor.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Wheaton, MD our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Wheaton, MD our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Wheaton :Studies show using a public adjuster in Wheaton, MD has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Wheaton works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Montgomery County, MD we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Wheaton, MD services surrounding cities:Aspen Hill, White Oak, North Bethesda, Colesville, Hillandale, Bethesda, Takoma Park, Adelphia,Langley Park,Fairland, Rockville and Chillum

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Wilson, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Wilson, NC our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Wilson :Studies show using a public adjuster in Wilson, NC has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters inWilson works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Wilson County, NC we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Wilson, NC services surrounding cities:Rocky Mount, Goldsboro, Tarboro, Smithfield, Clayton, Greenville, Kinston, Wake Forest, Garner, Raleigh, Dunn, Cary, Washington and Henderson.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experienced Public Adjusters in Bowie, MD our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Experienced Public Adjusters in Bowie, MD our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Bowie :Studies show using a public adjuster in Bowie, MD has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Bowie works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Prince George’s County we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

All American Public Adjusters in Bowie, MD services surrounding cities:Glenn Dale, Crofton, Greenbelt, South laurel, Mitchellville, New Carrollton, Odenton, Beltsville, Laurel, Largo, East Riverdale, Kettering, College Park and Severn.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster