Experience d Public Adjusters in Elkhart, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Elkhart, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

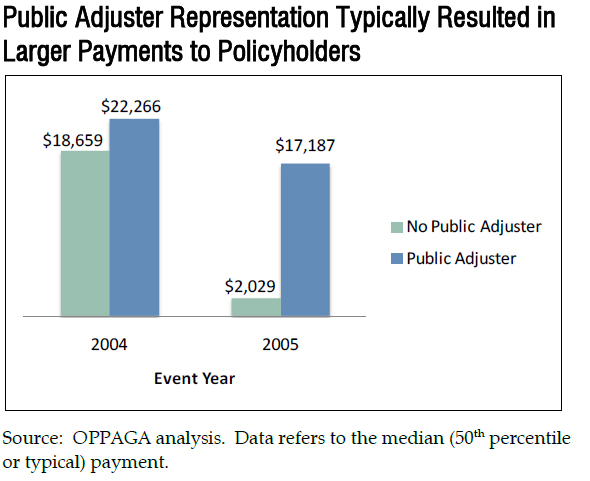

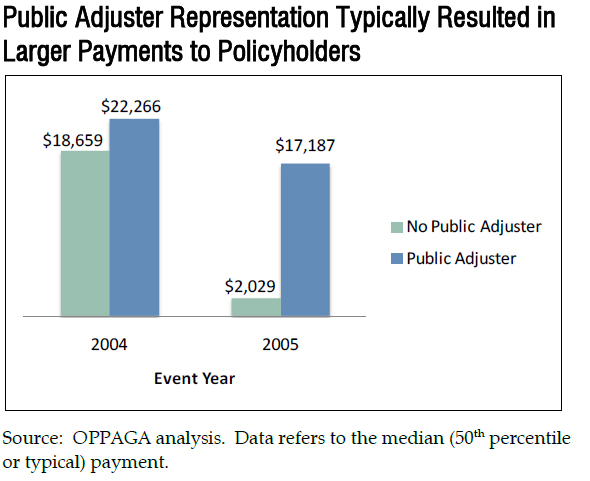

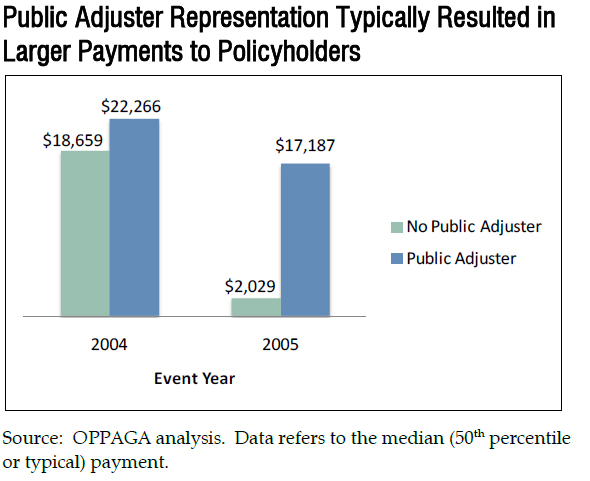

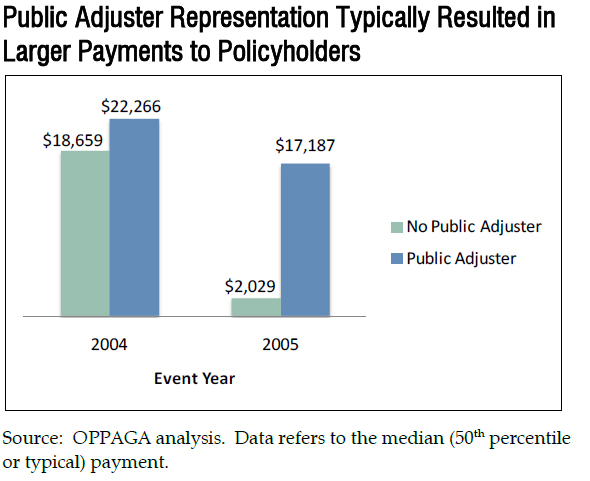

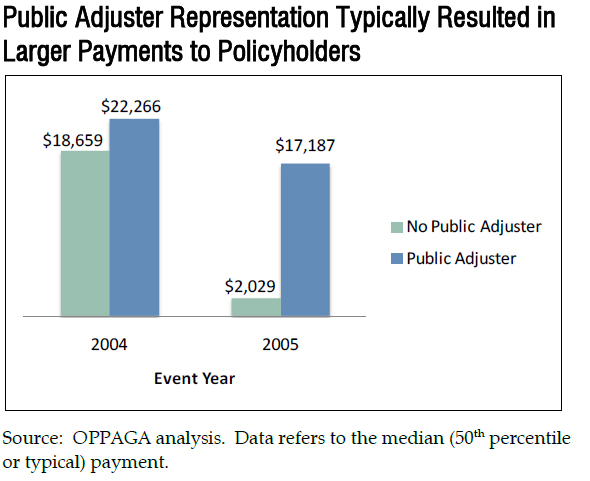

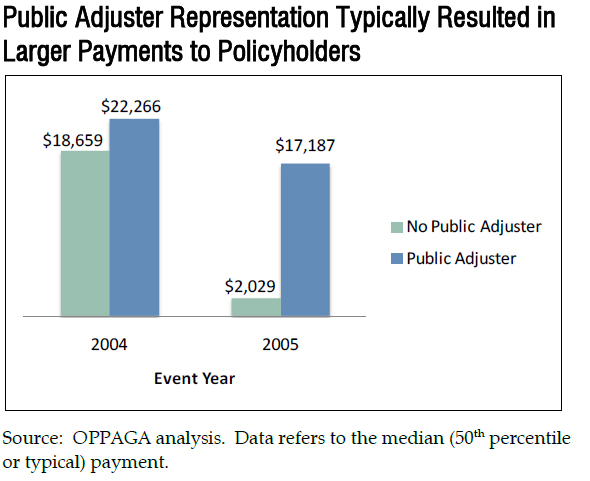

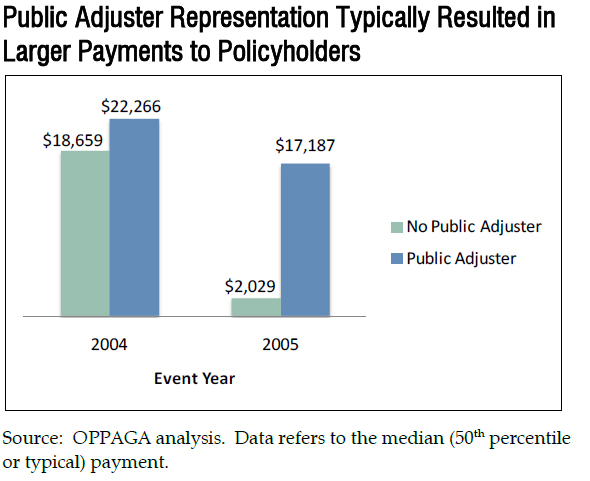

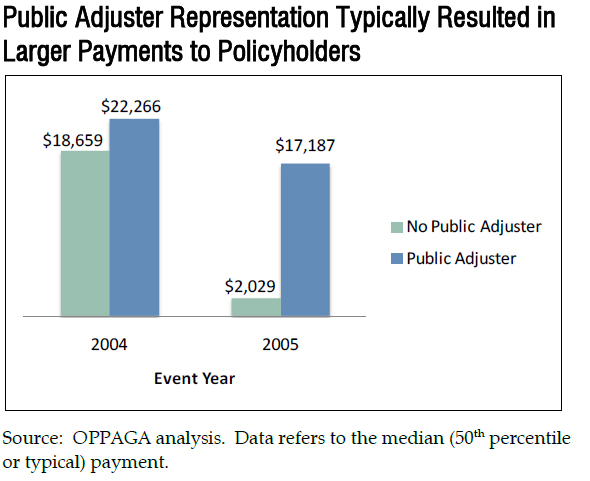

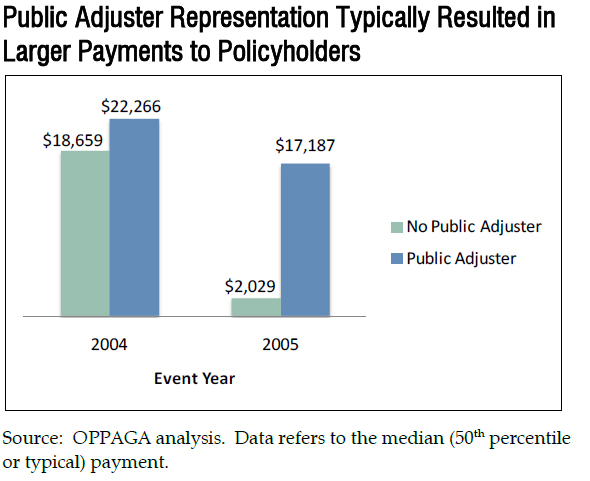

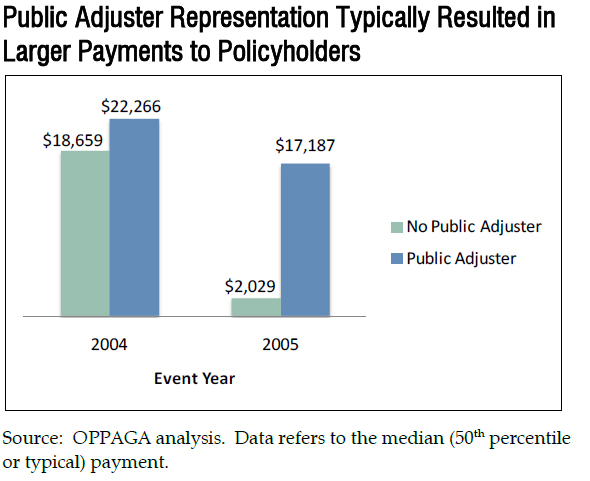

Why Use Public Adjuster in Elkhart ,:Studies show using a public adjuster in Elkhart, IN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Elkhart works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Elkhart County, IN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Elkhart, IN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

Zip Codes We Service:46514, 46516, 46517

- Published in Public Adjuster

Experience d Public Adjusters in St. Louis Park, MN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in St. Louis Park, MN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in St. Louis Park,:Studies show using a public adjuster in St. Louis Park, MN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in St. Louis Park works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Hennepin County, MN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in St. Louis Park, MN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

Zip Codes We Service: 55343, 55416, 55424, 55426, 55436, 55441.

- Published in Public Adjuster

Experience d Public Adjusters in Lafayette, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Lafayette, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Lafayette ,:Studies show using a public adjuster in Lafayette, IN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Lafayette works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Tippecanoe County, IN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Lafayette, IN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

Zip Codes We Service: 47901, 47904, 47909.

- Published in Public Adjuster

Experience d Public Adjusters in Edina, MN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Edina, MN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Edina,:Studies show using a public adjuster in Edina, MN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Edina works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Hennepin County, MN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Edina,MN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

Zip Codes We Service: 55343, 55410, 55416, 55423, 55424, 55436.

- Published in Public Adjuster

Experience d Public Adjusters in Murfreesboro, TN our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Murfreesboro, TN our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Murfreesboro :Studies show using a public adjuster in Murfreesboro, TN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Murfreesboro works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Rutherford County County, TN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Murfreesboro, TN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Palatine,IL our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Palatine,IL our goal is to help you when disaster strikes. 20 Yr experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Palatine:Studies show using a public adjuster in Palatine,IL has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Palatine works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Cook County County, IL we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Palatine, IL services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experienced Public Adjusters in Muncie, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Muncie :Studies show using a public adjuster in Muncie, IN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Muncie works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Delaware County,IN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

All American Public Adjusters in Muncie, IN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has Their Own Adjuster Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experienced Public Adjusters in Fishers, IN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Fishers:Studies show using a public adjuster in Fishers, IN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Fishers works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Hamilton County,IN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

All American Public Adjusters in Fishers, IN services surrounding cities:

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has Their Own Adjuster Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Clarksville, TN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Clarksville, TN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Clarksville :Studies show using a public adjuster in Clarksville, TN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Clarksville, works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Montgomery County, TN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Clarksville, T N services surrounding cities: Springfield, Dickson, Goodlettsville, Hendersonville, Brentwood, Portland, Franklin, Gallatin, Mount Juliet and Paris.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster

Experience d Public Adjusters in Knoxville, TN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

d Public Adjusters in Knoxville, TN our goal is to help you when disaster strikes. Experienced public adjuster will come to you and evaluate your property damage along with your policy information. We will assist you with properly reporting your loss to your insurance company. We will then prepare an estimate for your insurance carrier and work with your insurance adjuster to get you the maximum settlement. Our company has years of experience handling property damage claims. Our company is extremely knowledgeable and experienced with reference to property damage, code requirements, law changes, and insurance policies.Don’t Forget the burden of from lies solely on the policy holder. Insurance company has there own adjuster why don’t you.

Why Use Public Adjuster in Knoxville:Studies show using a public adjuster in Knoxville, TN has resulted in higher insurance claim settlements to the policy holder. All American Public adjusters in Knoxville works solely on the behalf of the policy holder not the insurance company.

Goal: Public Adjuster will examine your fire damage loss and determine the cause of loss and make sure its a covered loss in your insurance policy before opening a claim. Public adjuster goal is to write up an estimate and negotiate on the damage with your insurance company to get you the maximum your home deserves.

It is critical to document and report the loss immediately after Water Damage & fire Damage claim in order to prevent a claim denial. Insurance companies will send their own adjuster to your home, and it is important to have someone representing your best interest. Don’t let the insurance company dictate the loss – remember the burden of proof solely lies on you. Let us prepare your estimate so we know how much is owed to you for your insurance claim damage.

We Will Represent You and Handle Your Claim

- File or Re-Open Existing claim

- Investigate and Document Claim

- Inspection with Insurance Company

- Negotiate the Maximum Insurance Claim Settlement

Insurance companies have a professional insurance adjuster representing them in the claim. Home owners have the same opportunity to hire a professional adjuster who has THEIR interests in mind.

As Public Adjusters in Knox County, TN we have professional experience in handling many types of claims:

- Residential and Commercial Claims

- Fire Damage claims

- Water Damage Claims

- Wind claims, Roof Damage Claims, Hail Damage Claim

- Vandalism Claims,

- Flood Damage

- Plumbing Claims – Slab Leaks, pipe break, pipe leaks

- Roof damage Claim

- Hail Damage

Public Adjusters in Knoxville, T N services surrounding cities: Alcoa, Farragut, Maryville, Clinton, Oak Ridge, Sevierville, Lenoir City, Morristown, Athens, Crossville, Greeneville, Cleveland and Kingsport.

CALL FOR A FREE INSURANCE CONSULTATION

CALL FOR A FREE INSURANCE CONSULTATION

Call Today!

(888) 550 – 9336

Insurance Company Has their Own Adjusters Why Don’t You!

All American Public Adjusters

- Published in Public Adjuster